First Party Coverage Cyber Insurance Market Overview: Key Drivers and Challenges

"Executive Summary First Party Coverage Cyber Insurance Market :

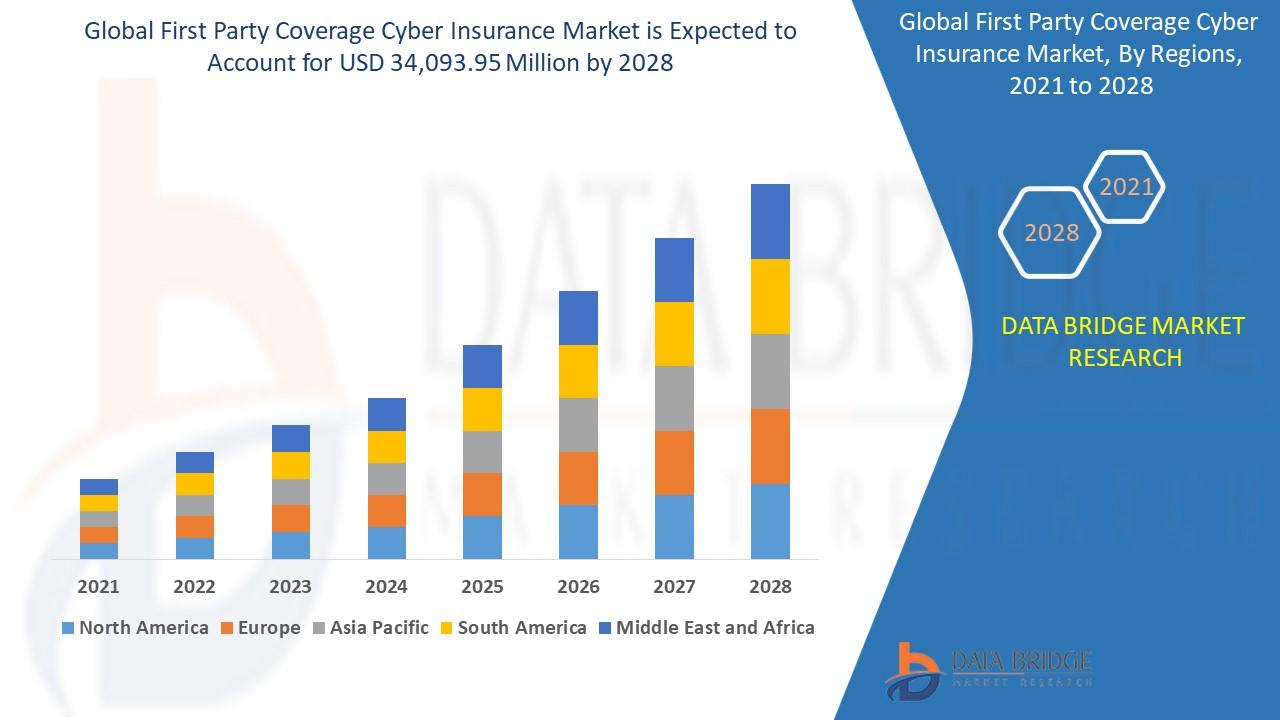

First party coverage cyber insurance market is expected to reach USD 34,093.95 million by 2028 witnessing market growth at a rate of 20.10% in the forecast period of 2021 to 2028.

The First Party Coverage Cyber Insurance Market report contains appropriate explanation about the market definition, classifications, applications, engagements, and global industry trends. The report seems very helpful to the clients in drawing target audiences before launching any advertising campaign. It also takes in consideration analysis, estimation, and discussion of important industry trends, market size, and market share. This market research report plays very essential role when it is about achieving far-fetched growth in the business. The global First Party Coverage Cyber Insurance Market research report is structured by precisely understanding the customer requirements. This business report bestows with the strength to any kind of business whether it is large, medium or small for surviving and succeeding in the market.

The estimations of CAGR values are quite essential which helps businesses decide upon the investment value over the time period. The global First Party Coverage Cyber Insurance Market report is perfectly analyzed on the basis of numerous regions. Business can be taken to the peak level of growth and success with the important market insights covered in this report. Another chief part of this First Party Coverage Cyber Insurance Market report is the competitive landscape which gives a clear insight into the market share analysis and actions of key industry players. This market report also involves strategic profiling of the major players in the market, comprehensive analysis of their basic competencies, and thereby keeping competitive landscape of the market in front of the client.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive First Party Coverage Cyber Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-first-party-coverage-cyber-insurance-market

First Party Coverage Cyber Insurance Market Overview

**Segments**

- On the basis of coverage type, the global first-party coverage cyber insurance market can be segmented into data breaches, business interruption, ransomware, and others. Data breaches segment is expected to dominate the market as companies are increasingly focusing on protecting sensitive information from cyber threats.

- Based on industry vertical, the market can be categorized into healthcare, BFSI, IT and telecom, retail, and others. BFSI sector is anticipated to hold a significant market share due to the high volume of financial transactions and sensitive data it handles.

- By organization size, the market is divided into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are projected to witness a higher growth rate as they become more vulnerable to cyber attacks and are actively investing in cybersecurity measures.

- On the basis of geography, the global first-party coverage cyber insurance market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is expected to lead the market due to the presence of key market players and high awareness about cybersecurity among organizations.

**Market Players**

- Some of the key players in the global first-party coverage cyber insurance market include AIG, Chubb, Allianz, AXA, Zurich Insurance Group, Munich Re, Berkshire Hathaway, Lloyd's, and American International Group. These companies are focusing on strategic partnerships, acquisitions, and product innovations to strengthen their market position and expand their customer base.

The global first-party coverage cyber insurance market is witnessing significant growth driven by the increasing frequency and sophistication of cyber threats across various industries. As organizations continue to digitize their operations and store sensitive data online, the need for robust insurance coverage to mitigate potential financial losses from cyber attacks becomes paramount. The focus on data breaches as a key segment indicates the growing awareness among companies about the importance of protecting sensitive information from unauthorized access. This trend is likely to drive the demand for first-party coverage cyber insurance solutions that specifically address data breach incidents.

In terms of industry verticals, the BFSI sector stands out as a key market segment due to the sector's high reliance on digital platforms for financial transactions and the handling of sensitive customer data. The sheer volume of financial transactions processed by banks and financial institutions makes them lucrative targets for cybercriminals, driving the need for comprehensive cyber insurance coverage to safeguard against potential financial losses resulting from cyber attacks. As the BFSI sector continues to embrace digital transformation and adopt new technologies, the demand for first-party coverage cyber insurance solutions is expected to experience steady growth.

The segmentation based on organization size highlights the increasing vulnerability of small and medium-sized enterprises (SMEs) to cyber threats. SMEs often lack the resources and expertise to implement robust cybersecurity measures, making them easy targets for cyber attacks. As a result, SMEs are increasingly investing in cyber insurance to protect their businesses from the financial impact of data breaches, ransomware attacks, and other cyber incidents. This shift towards proactive risk management strategies is expected to drive the growth of the cyber insurance market among SMEs in the coming years.

From a geographical perspective, North America is poised to lead the global first-party coverage cyber insurance market, primarily due to the strong presence of key market players and the high level of awareness about cybersecurity among organizations in the region. The US, in particular, has been at the forefront of cybersecurity initiatives, with both government agencies and private enterprises investing significantly in cybersecurity measures to combat cyber threats. This proactive approach towards cybersecurity readiness positions North America as a key market for first-party coverage cyber insurance solutions.

In conclusion, the global first-party coverage cyber insurance market is evolving rapidly in response to the escalating cyber threats faced by organizations worldwide. The emphasis on data breaches, the dominance of the BFSI sector, the growing adoption of cyber insurance among SMEs, and the leadership of North America in the market underscore the diverse dynamics shaping the future of the cyber insurance industry. Key players in the market are expected to continue innovating and forging strategic partnerships to meet the evolving needs of organizations seeking robust protection against cyber risks.The global first-party coverage cyber insurance market is expected to witness continued growth and evolution as organizations across various industries prioritize cybersecurity measures to combat the increasing frequency and sophistication of cyber threats. With a strong emphasis on data breaches, companies are increasingly investing in robust insurance coverage to protect sensitive information from unauthorized access, driving the demand for first-party coverage cyber insurance solutions tailored to address data breach incidents specifically.

The BFSI sector is poised to remain a key market segment due to its heavy reliance on digital platforms for financial transactions and the handling of sensitive customer data. As banks and financial institutions face a growing number of cyber attacks targeting their high volume of financial transactions, the need for comprehensive cyber insurance coverage to mitigate potential financial losses becomes increasingly crucial. The continued digital transformation within the BFSI sector is expected to drive steady growth in the adoption of first-party coverage cyber insurance solutions.

Small and medium-sized enterprises (SMEs) are increasingly recognizing their vulnerability to cyber threats and are actively seeking cyber insurance coverage to protect their businesses from the financial impact of data breaches, ransomware attacks, and other cyber incidents. As SMEs continue to invest in cybersecurity measures to enhance their resilience against cyber threats, the demand for cyber insurance tailored to the needs of smaller organizations is expected to rise, driving growth in the segment.

Geographically, North America is positioned as a leader in the global first-party coverage cyber insurance market, driven by the presence of key market players and the high level of cybersecurity awareness among organizations in the region. The proactive approach towards cybersecurity readiness in the US, exemplified by significant investments in cybersecurity initiatives by both government agencies and private enterprises, positions North America as a key market for first-party coverage cyber insurance solutions.

In conclusion, the global first-party coverage cyber insurance market is characterized by evolving dynamics shaped by the increasing emphasis on cybersecurity, the dominance of the BFSI sector, the growing adoption of cyber insurance among SMEs, and the leadership of North America in driving market growth. Key players in the industry are expected to continue innovating and forming strategic partnerships to meet the evolving needs of organizations seeking comprehensive protection against cyber risks in an increasingly digital landscape.

The First Party Coverage Cyber Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-first-party-coverage-cyber-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

How First Party Coverage Cyber Insurance Market Report Would Be Beneficial?

- Anyone who are directly or indirectly connected in value chain of First Party Coverage Cyber Insurance Market industry and needs to have Know-How of market trends

- Marketers and agencies doing their due diligence

- Analysts and vendors looking for First Party Coverage Cyber Insurance Market intelligence about First Party Coverage Cyber Insurance Market Industry

- Competition who would like to correlate and benchmark themselves with market position and standings in current scenario

Browse More Reports:

Global Taste Modulators Market

Asia Pacific Hydrocephalus Market

Europe Hydrocephalus Market

Middle East and Africa Phosphorus and Derivatives Market

Global Laundry Detergent Pods Market

Global Hair Transplant Market

Global Spintronics Market

Global Textured Pea Protein Market

Global Healthcare Information Technology (IT) Integration Market

Europe Agriculture Nets Market

Global Cosmetic Preservative Market

Global Angina Pectoris Drugs Market

Asia-Pacific Respiratory Care Devices Market

Global Playout Solutions Market

North America Core Materials Market

Asia-Pacific AGM Batteries for Cars Market

Middle East and Africa Compound Management Market

Global Cereal Ingredients Market

Global Legal Marijuana Market

Asia-Pacific Orthopedic Implants Market

Global Surface Mount Technology Electronics Packaging Market

Middle East and Africa Gastric Cancer Diagnostics Market

Europe Drug Screening Market

Global Toxic Plasma Methotrexate Concentrations Market

Global Industrial Oils Market

Global Identity as a Service (IDaaS) Market

Global Thymus (T)-Cell Therapy Market

Global Pseudohypoaldosteronism Type 1 Market

Global Spine Biologics Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness