Accidental Damage Insurance Market Research Report: Growth, Share, Value, Trends, and Insights

"Executive Summary Accidental Damage Insurance Market :

CAGR Value

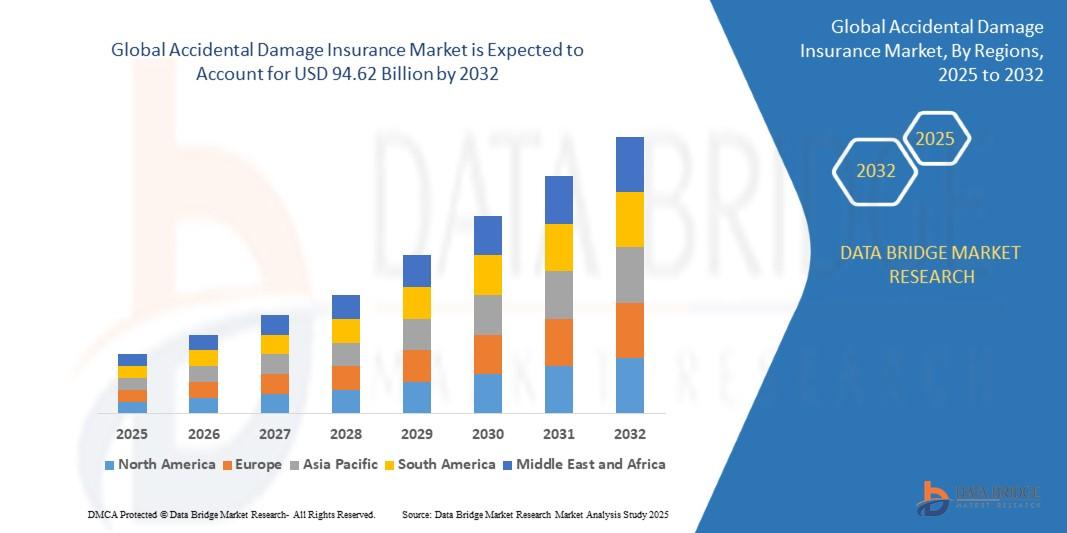

The global accidental damage insurance market size was valued at USD 71.3 billion in 2024 and is projected to reach USD 94.62 billion by 2032, with a CAGR of 3.60% during the forecast period of 2025 to 2032.

To achieve success in the competition of global market place, going for this global Accidental Damage Insurance Market research report is the key. Besides, it presents the company profile, product specifications, production value, contact information of manufacturer and market shares for company. This market report strategically analyses the growth trends and future prospects. The report gives details about the emerging trends along with key drivers, challenges and opportunities in the industry. Moreover, this Accidental Damage Insurance Market report also provides strategic profiling of top players in the industry, comprehensively analyzing their core competencies, and drawing a competitive landscape for the market.

The Accidental Damage Insurance Market business document lists and studies the leading competitors, also gives the insights with strategic industry analysis of the key factors influencing the market dynamics. A market research analysis and estimations carried out in this Accidental Damage Insurance Market report aids businesses in gaining knowledge about what is already there in the market, what market looks forward to, the competitive background and steps to be followed for outdoing the rivals. This is a professional and in-depth study on the current state which focuses on the major drivers and restraints of the key market players.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Accidental Damage Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-accidental-damage-insurance-market

Accidental Damage Insurance Market Overview

**Segments**

- By Type: Home Insurance, Travel Insurance, Mobile Device Insurance, Automotive Insurance, Others

- By Application: Personal, Commercial

- By End-User: Individuals, Corporates

The global accidental damage insurance market is segmented based on the type of insurance, application, and end-user. In terms of types of insurance, the market is divided into home insurance, travel insurance, mobile device insurance, automotive insurance, and others. Home insurance covers any accidental damage that may occur to a person's residence or belongings. Travel insurance provides coverage for any accidents or damages that may occur while traveling. Mobile device insurance offers protection for mobile phones, tablets, and other electronic devices. Automotive insurance covers damages to vehicles due to accidents. The market also caters to other niche forms of accidental damage insurance. In terms of application, the market is segmented into personal and commercial insurance. Personal insurance is for individual consumers looking to protect themselves and their belongings, while commercial insurance caters to businesses and organizations. Furthermore, the market is segmented based on end-users, including individuals and corporates who seek accidental damage insurance for their personal or business needs.

**Market Players**

- Allianz

- AXA

- Munich Re Group

- Assicurazioni Generali S.p.A.

- Chubb

- Zurich Insurance Group

- MS&AD Insurance Group Holdings, Inc.

- American International Group, Inc.

- Aviva

- Nippon Life Insurance Company

Key players operating in the global accidental damage insurance market include Allianz, AXA, Munich Re Group, Assicurazioni Generali S.p.A., Chubb, Zurich Insurance Group, MS&AD Insurance Group Holdings, Inc., American International Group, Inc., Aviva, and Nippon Life Insurance Company. These companies offer a wide range of accidental damage insurance products catering to different types of accidental damage and customer needs. They have a strong global presence and leverage advanced technologies and customer-centric strategies to provide comprehensive insurance coverage and exceptional customer service to their clients. These market players invest significantly in research and development to introduce innovative insurance products and enhance their competitive position in the market. With a focus on expanding their market presence and enhancing their product portfolios, these companies play a crucial role in driving the growth of the global accidental damage insurance market.

The global accidental damage insurance market is experiencing steady growth driven by increasing awareness among individuals and businesses about the importance of protecting against unexpected damages. With the rise in natural disasters, accidents, and other unforeseen events, there is a growing realization of the need for insurance coverage to mitigate financial risks associated with such incidents. The market is witnessing a surge in demand for different types of accidental damage insurance, including home insurance, travel insurance, mobile device insurance, automotive insurance, and other specialized forms of coverage. This diversification in insurance offerings caters to a wide range of customer needs and preferences, contributing to the overall growth of the market.

Key market players such as Allianz, AXA, and Zurich Insurance Group are at the forefront of driving innovation and expansion in the accidental damage insurance market. These industry giants leverage their strong financial position, global reach, and technological capabilities to develop customized insurance solutions that address evolving customer requirements. By investing in research and development, these companies continuously enhance their product offerings, streamline their operational efficiency, and improve customer engagement to maintain a competitive edge in the market. Additionally, partnerships, mergers, and acquisitions play a significant role in shaping the competitive landscape of the market, allowing key players to diversify their service portfolios and strengthen their market presence.

Moreover, the growing trend of digitization and technological advancements is reshaping the insurance landscape, enabling market players to offer seamless digital experiences, personalized services, and quick claim resolutions to their customers. Artificial intelligence, data analytics, and blockchain technology are being increasingly adopted to streamline insurance processes, enhance risk assessment, and improve fraud detection, ultimately leading to better customer satisfaction and operational efficiency for insurance companies. Furthermore, as regulatory frameworks evolve and consumer expectations change, market players need to adapt by embracing sustainable practices, transparency, and ethical business conduct to build trust and credibility among their stakeholders.

Looking ahead, the global accidental damage insurance market is poised for robust growth driven by factors such as increasing urbanization, changing lifestyles, and the growing emphasis on risk management. As individuals and businesses become more proactive in safeguarding their assets and liabilities, the demand for comprehensive insurance coverage is expected to rise. Market players that can demonstrate agility, innovation, and customer-centricity will likely thrive in this dynamic market environment, capturing new opportunities and sustaining long-term growth. In conclusion, the global accidental damage insurance market presents lucrative prospects for key players to capitalize on emerging trends, address evolving customer needs, and drive innovation in the insurance industry.The global accidental damage insurance market is witnessing a transformation fueled by various factors influencing consumer behavior and industry dynamics. One significant trend shaping the market is the increasing focus on customized insurance solutions tailored to individual needs and preferences. As customers seek more personalized coverage options, insurance providers are innovating their product offerings to meet these demands effectively. This trend is driving competition among market players to differentiate themselves through unique services, flexible policies, and enhanced customer experiences.

Another notable trend in the accidental damage insurance market is the adoption of advanced technologies to streamline operations and improve service delivery. Insurtech solutions, including artificial intelligence, data analytics, and blockchain technology, are revolutionizing how insurance companies assess risks, process claims, and interact with customers. By leveraging these digital tools, insurers can enhance operational efficiency, reduce costs, and provide faster, more convenient services to policyholders. As technology continues to evolve, we can expect further advancements in digital innovation across the insurance value chain.

Additionally, the market is experiencing a shift towards sustainable and ethical business practices driven by evolving regulatory frameworks and changing consumer expectations. Insurers are increasingly embracing environmental sustainability, social responsibility, and good governance to build trust and credibility with stakeholders. By demonstrating a commitment to responsible business conduct, market players can not only meet regulatory requirements but also enhance their reputation and attractiveness to environmentally conscious customers.

Moreover, the global accidental damage insurance market is witnessing a rise in strategic partnerships, collaborations, and mergers & acquisitions as companies seek to expand their market presence, diversify their product portfolios, and unlock synergies. By forming alliances with other industry players or acquiring complementary businesses, insurers can access new markets, technologies, and capabilities that strengthen their competitive position and drive growth opportunities.

Looking ahead, the global accidental damage insurance market is poised for continued expansion as insurers adapt to changing market dynamics, technological advancements, and customer preferences. To succeed in this increasingly competitive landscape, market players must focus on innovation, customer-centricity, sustainability, and strategic collaborations to differentiate themselves and capture new growth avenues. By staying agile, responsive to market trends, and committed to delivering value-added services, insurers can navigate the evolving landscape of accidental damage insurance and seize emerging opportunities for sustainable growth.

The Accidental Damage Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-accidental-damage-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Influence of this Market:

- Comprehensive assessment of all opportunities and risk in this Accidental Damage Insurance Market

- This Market recent innovations and major events

- Detailed study of business strategies for growth of the this Market-leading players

- Conclusive study about the growth plot of the Accidental Damage Insurance Market for forthcoming years

- In-depth understanding of this Accidental Damage Insurance Market particular drivers, constraints and major micro markets

- Favourable impression inside vital technological and market latest trends striking this Market

- To provide historical and forecast revenue of the market segments and sub-segments with respect to four main geographies and their countries- North America, Europe, Asia, and Rest of the World (ROW)

- To provide country level analysis of the market with respect to the current market size and future prospective

Browse More Reports:

Global Himalayan Pink Salt Market

U.S. Hernia Mesh Repair Devices Market

North America Dengue Treatment Market

Global Antimony Market

Global Residential Bathroom Cabinets Market

Global Vibration Energy Harvesting Market

Global Orthopedic Joint Reconstruction Market

Global Cardiac Ablation Devices Market

North America Food Flavors Market

Global Mobile Medical Apps Market

Global Exploration and Production Software Market

Global Portable Orthopedic Devices Market

Global Leukotriene Inhibitors Market

Global Barakat Syndrome Market

Global Myxoma Market

Middle East and Africa Heat Shrink Tubing Market

Middle East and Africa Digital Scent Technology Market

North America Omega-3 Ingredients for Pharmaceuticals Market

Global Data Encryption Market

Global Dry Milling Market

Global Glass Pasteur Pipettes Market

Global Central Nervous System (CNS) Stimulants Market

Global Sinusitis Treatment Drugs Market

Global Heating, Ventilation and Air Conditioning (HVAC) Insulation Market

Global Cyclooxygenase 1 Inhibitor Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"