How does Data analytics detect fraud?

Why Fraud Detection Needs Data Analytics

Imagine a credit card purchase in New York, followed five minutes later by another swipe in London. Or a healthcare claim that bills for 20 procedures in a single day for the same patient. To the human eye, these red flags might take days or even months to surface. But with data analytics, fraud detection happens in seconds.

Fraud is a growing challenge for businesses across industries. According to the Association of Certified Fraud Examiners (ACFE), organizations worldwide lose an estimated 5% of revenue annually due to fraud. Traditional fraud detection methods manual audits, random checks, or customer complaints are no longer enough. The sheer scale and complexity of modern transactions demand smarter, faster solutions.

This is where data analytics comes in. By analyzing large datasets, spotting unusual behavior, and predicting fraudulent activities, data analytics equips businesses with the tools to stay one step ahead of fraudsters. And for aspiring professionals, skills in fraud analytics are often built through Data analyst online classes with placement, including beginner-friendly training and certification programs that bridge theory with practice.

In this blog, we’ll break down exactly how data analytics detects fraud, the techniques and technologies behind it, real-world applications, and the skills you can learn to join this growing field.

What Is Fraud Detection in Data Analytics?

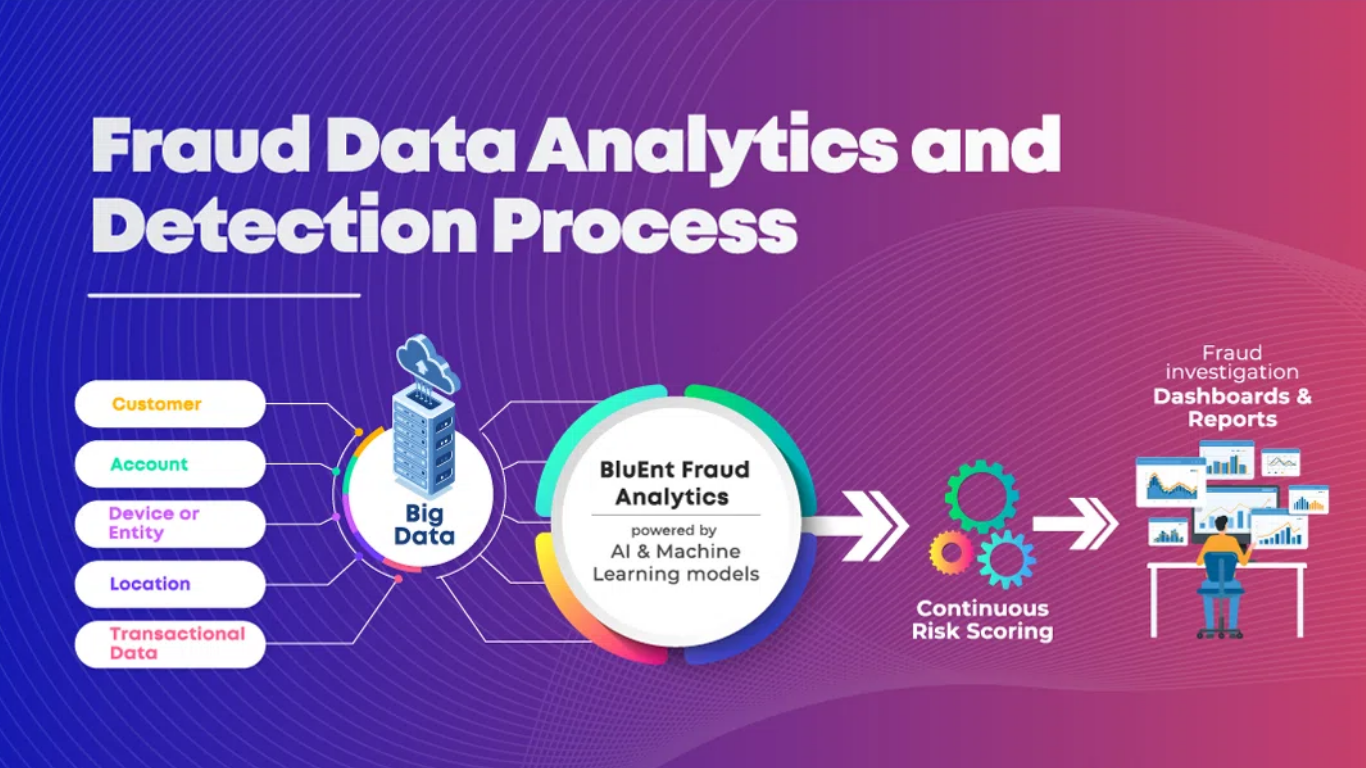

Fraud detection in data analytics is the process of identifying illegal or suspicious activity within structured and unstructured data. It involves:

-

Collecting data from multiple sources such as bank transactions, insurance claims, or e-commerce logs.

-

Analyzing data patterns to establish what "normal" looks like.

-

Flagging anomalies or outliers that deviate from expected behavior.

-

Predicting fraud likelihood using statistical models, machine learning, and artificial intelligence.

The role of analytics is not only to identify fraud after it happens but also to prevent fraud before it occurs.

Key Techniques Used in Fraud Detection with Data Analytics

Fraud detection combines statistics, machine learning, and domain knowledge, skills that are often introduced in Data analyst online classes for beginners. Below are the most widely used techniques:

1. Descriptive Analytics: Spotting Patterns in Past Data

Descriptive analytics reviews historical transactions to identify common fraud scenarios. For example, repeated failed login attempts followed by a successful one may suggest credential theft.

-

Real-world example: In retail, analysts examine previous fraudulent purchases to recognize red flags such as high-volume purchases of luxury goods followed by quick reselling.

2. Predictive Analytics: Using Models to Forecast Fraud

Predictive analytics applies machine learning models to estimate the probability of fraud before it occurs.

-

Logistic regression, decision trees, and random forests help score transactions as “likely fraudulent” or “normal.”

-

Example: Banks use predictive models to assign a fraud risk score to each credit card transaction.

3. Anomaly Detection: Identifying Outliers

Anomalies are unusual behaviors that deviate from normal data patterns. These may not always be fraud, but they are signals worth investigating.

-

Example: A healthcare provider billing for 50 patient consultations in one day triggers anomaly detection algorithms.

4. Network Analysis: Detecting Fraud Rings

Fraud is not always an individual act. Sometimes, it’s organized. Network analysis maps relationships between entities (customers, accounts, devices) to reveal hidden fraud networks.

-

Example: Insurance companies use this to identify groups of policyholders and clinics collaborating to file false claims.

5. Real-Time Analytics: Catching Fraud Instantly

Streaming analytics tools analyze transactions in real-time. If something looks suspicious, the system blocks the activity immediately.

-

Example: E-commerce platforms use real-time fraud detection to stop suspicious checkout attempts before payments are processed.

Fraud Detection Across Industries Using Data Analytics

Fraud looks different across sectors, but data analytics provides adaptable solutions.

1. Banking and Financial Services

-

Credit card fraud: Identifying unusual purchases, foreign transactions, or multiple withdrawals within minutes.

-

Loan fraud: Detecting fake documents or fabricated identities during loan applications.

-

Money laundering: Using analytics to trace complex transaction patterns across multiple accounts.

2. Insurance

-

Spotting duplicate claims submitted under different names.

-

Detecting fake accidents or inflated medical bills.

-

Network analysis to uncover fraud rings involving doctors, patients, and legal firms.

3. E-Commerce and Retail

-

Identifying stolen card usage at checkout.

-

Detecting fake reviews or return frauds (customers buying, using, then returning items).

-

Monitoring high-volume gift card purchases as a fraud signal.

4. Healthcare

-

Identifying unnecessary tests or treatments billed repeatedly.

-

Tracking prescription fraud (patients visiting multiple doctors for the same drugs).

-

Cross-referencing claims with medical history for anomalies.

5. Government and Public Sector

-

Tax fraud detection using income vs spending patterns.

-

Benefits fraud by cross-checking eligibility with real data.

-

Cyber fraud targeting government payment systems.

Tools and Technologies for Fraud Detection

Fraud detection relies on a mix of traditional statistical tools and advanced machine learning platforms. Some commonly used tools include:

-

Python & R: For data cleaning, anomaly detection, and predictive modeling.

-

SQL: To query and extract suspicious data patterns from large databases.

-

Power BI & Tableau: To create fraud dashboards and visualize risk trends.

-

Machine Learning Libraries: Scikit-learn, TensorFlow, PyTorch for fraud prediction models.

-

Big Data Platforms: Hadoop, Spark for analyzing massive transaction datasets.

Hands-On Example: Fraud Detection with Python

Here’s a simplified Python snippet to show how anomaly detection works for fraud detection.

import pandas as pd

from sklearn.ensemble import IsolationForest

# Load transaction dataset

data = pd.read_csv("transactions.csv")

# Select features for analysis

features = data[['transaction_amount', 'transaction_time_gap', 'location_score']]

# Apply Isolation Forest for anomaly detection

model = IsolationForest(contamination=0.02)

data['fraud_flag'] = model.fit_predict(features)

# -1 indicates anomaly (potential fraud), 1 indicates normal

frauds = data[data['fraud_flag'] == -1]

print("Potential Fraudulent Transactions Detected:")

print(frauds.head())

This code uses Isolation Forest, a popular anomaly detection algorithm, to flag suspicious transactions. While real-world fraud models are far more complex, Data analyst online classes often use such examples to give learners a glimpse of how analytics powers fraud detection.

Benefits of Using Data Analytics for Fraud Detection

-

Speed and Accuracy: Automated fraud detection is faster and more accurate than manual audits.

-

Scalability: Can handle millions of transactions simultaneously.

-

Proactive Defense: Predicts fraud before it happens.

-

Cost Reduction: Prevents revenue losses and lowers investigation costs.

-

Customer Trust: Reduces false positives and keeps customer accounts secure.

Challenges in Fraud Detection with Data Analytics

While powerful, fraud detection systems face hurdles:

-

Evolving fraud tactics: Fraudsters constantly adapt to bypass detection models.

-

False positives: Some flagged transactions may turn out legitimate, causing inconvenience.

-

Data quality issues: Incomplete or inconsistent data reduces detection accuracy.

-

Privacy concerns: Collecting and analyzing sensitive data raises ethical considerations

Career Path: Building Skills in Fraud Analytics

Fraud analytics is a rewarding career path. Professionals skilled in this field are in high demand in finance, insurance, healthcare, and cybersecurity.

To gain these skills, many learners turn to Best data analyst online classes, which offer:

-

Data analyst online classes with placement: Helping learners secure roles in fraud analytics teams.

-

Data analyst online classes with certificate: Providing proof of expertise to employers.

-

Data analyst online classes for beginners: Making fraud analytics accessible even without prior IT experience.

-

Comprehensive data analyst online classes: Covering SQL, Python, data visualization, and machine learning with real-world fraud case studies.

Future of Fraud Detection with Data Analytics

The future of fraud detection lies in:

-

AI-powered fraud prediction using deep learning.

-

Behavioral biometrics like keystroke dynamics to detect account takeovers.

-

Blockchain analytics to track cryptocurrency fraud.

-

Continuous learning systems where fraud detection models evolve as fraudsters adapt.

With the rapid growth of digital transactions, fraud analytics will continue to be one of the most crucial applications of data analytics worldwide.

Conclusion

Fraud is becoming more sophisticated, but so are the tools to fight it. Data analytics empowers organizations to detect, prevent, and investigate fraud with speed and accuracy. From anomaly detection to predictive modeling, businesses can protect revenue and build customer trust.

For professionals, learning fraud detection through Data analyst online classes with certificate especially those with placement, certificates, and beginner-friendly options opens the door to one of the most exciting and impactful careers in data analytics today.

Start your journey today with structured data analyst online classes and take the first step toward becoming a fraud analytics expert.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness