Introduction:

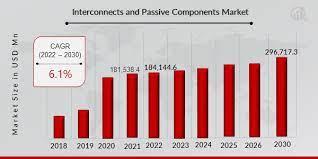

Interconnect And Passive Components Market Size is expected to grow USD 296,717.3 Million by 2030, at (CAGR) of 6.1% during the forecast period (2022 - 2030).

Interconnects and passive components serve as the backbone of electronic systems, facilitating the flow of signals, power, and data between components. From connectors and cables to resistors, capacitors, and inductors, these essential components play a critical role in the design, functionality, and reliability of electronic devices and systems. As industries continue to demand high-performance, miniaturized, and energy-efficient solutions, the interconnects and passive components market is experiencing significant growth and innovation.

Interconnects and Passive Components Market Analysis:

· The interconnects and passive components market encompasses a wide range of products and applications across industries such as telecommunications, consumer electronics, automotive, aerospace, healthcare, and industrial automation. Key product categories include connectors, cables, resistors, capacitors, inductors, and filters, among others. These components are essential for establishing electrical connections, managing signal integrity, and controlling electrical properties in electronic circuits and systems.

Interconnects and Passive Components Market Key Trends Driving Market Growth:

· Miniaturization and Integration: The trend towards smaller, lighter, and more compact electronic devices and systems is driving the demand for miniaturized interconnects and passive components. Manufacturers are developing innovative solutions with reduced form factors, higher component densities, and enhanced functionality to meet the size and weight constraints of modern electronics.

· High-Speed Data Transmission: With the proliferation of high-speed data transmission technologies such as 5G, Wi-Fi 6, and automotive Ethernet, there is a growing demand for interconnects and passive components capable of supporting increased data rates and bandwidth. High-performance connectors, cables, and signal integrity solutions are essential for ensuring reliable data transmission and minimizing signal degradation in high-speed communication systems.

· Industry 4.0 and IoT Connectivity: The rise of Industry 4.0 and the Internet of Things (IoT) is driving the adoption of interconnected devices and smart sensors in industrial automation, smart cities, and connected infrastructure projects. Interconnects and passive components play a crucial role in enabling IoT connectivity, sensor networks, and wireless communication protocols, facilitating data exchange and control in interconnected systems.

· Automotive Electrification and ADAS: The shift towards electric vehicles (EVs), autonomous driving technologies, and advanced driver assistance systems (ADAS) is fueling demand for interconnects and passive components with higher power handling capabilities, temperature resistance, and reliability. These components are essential for electric vehicle charging systems, battery management systems, and onboard sensors in next-generation automotive platforms.

· Renewable Energy and Green Technologies: The growing focus on sustainability and environmental conservation is driving the adoption of renewable energy sources such as solar and wind power. Interconnects and passive components are integral to renewable energy systems, providing efficient power distribution, energy storage, and conversion solutions for clean energy generation.

Innovations Shaping the Future

· High-Speed Interconnect Solutions: Manufacturers are developing high-speed connectors, cables, and backplane solutions capable of supporting data rates exceeding 100 gigabits per second (Gbps) for applications such as data centers, telecommunications networks, and high-performance computing.

· Miniature Passive Components: Advances in materials science and manufacturing techniques are enabling the development of miniature passive components with reduced footprints, higher power densities, and improved electrical performance for portable electronics, wearables, and IoT devices.

· Integrated Passive Devices (IPDs): Integrated passive devices combine multiple passive components, such as resistors, capacitors, and inductors, into a single package, offering space-saving and cost-effective solutions for compact electronic assemblies and miniaturized systems.

· Flexible and Stretchable Electronics: Flexible and stretchable interconnects and passive components are being developed for wearable electronics, biomedical devices, and flexible displays, enabling conformal integration and seamless integration into curved or irregular surfaces.

· Environmental Sustainability: Manufacturers are exploring eco-friendly materials and manufacturing processes for interconnects and passive components, including lead-free soldering, recyclable materials, and energy-efficient production techniques, to reduce the environmental impact of electronic manufacturing.

Get a free sample @ https://www.marketresearchfuture.com/sample_request/2411

Key Companies in the Interconnect And Passive Components market include:

· KYOCERA AVX COMPONENTS CORPORATION. (KYOCERA CORPORATION)

· Molex LLC

· Panasonic Corporation

· Ametek Inc.

· Amphenol Corporation

· Vishay Intertechnology, Inc.

· Murata Manufacturing Co. Ltd.

· TDK Corporation

· Samsung Electro-Mechanics

· Hosiden Corporation

· Fujitsu

· TE Connectivity

· Hon Hai Precision Industry Co. Ltd.

· HIROSE Electric Co. Ltd.

· Mouser Electronics, Inc.

Market Challenges and Opportunities

While the interconnects and passive components market share presents significant growth opportunities, it also faces challenges such as:

· Supply Chain Disruptions: The global semiconductor shortage and supply chain disruptions caused by the COVID-19 pandemic have affected the availability and pricing of interconnects and passive components, leading to supply constraints and longer lead times for electronic manufacturers.

· Technological Complexity: The increasing complexity of electronic systems, coupled with the demand for higher performance and reliability, presents challenges in designing and integrating interconnects and passive components into electronic assemblies. Manufacturers must address interoperability, compatibility, and reliability issues to meet customer requirements.

· Regulatory Compliance: Compliance with industry standards, regulations, and environmental directives such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) poses challenges for manufacturers in ensuring product compliance, certification, and environmental sustainability.

Get a regional report on US Interconnects and Passive Components Market