Office Furniture Market Size, Share, Price, Growth, Key Players, Analysis, Report, Forecast 2025-2032

Office Furniture Market: Furnishing the Future of Workspaces

Market Estimation & Definition

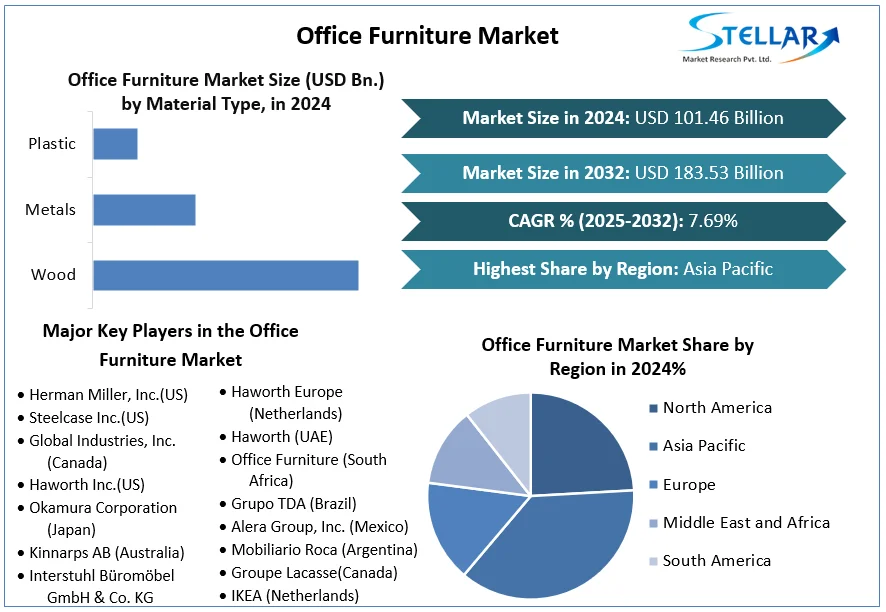

The global office furniture market was valued at approximately USD 101.46 billion in 2024 and is projected to reach about USD 183.53 billion by 2032, reflecting a compound annual growth rate (CAGR) of around 7.69% during 2025-2032.

“Office furniture” here refers to furnishings designed for workspaces—desks, chairs, tables, storage units, shelving systems, modular workstations, and related furnishings used in offices, co-working spaces, institutional settings and corporate environments. The category emphasises ergonomic design, aesthetics, adaptability to flexible work models, and supports productivity and wellness in the workplace.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/office-furniture-market/2478

Market Growth Drivers & Opportunity

Several key drivers and opportunities are fueling the growth of the office furniture market:

-

Shift in workplace design & return to office: As companies revisit their workplace strategies—moving from lockdowns and remote models back to hybrid or in-office formats—there is renewed investment in outfitting physical spaces with modern, flexible furniture.

-

Rise of co-working and flexible workspaces: The popularity of co-working offices, hot-desks, flexible leases and shared workspaces drives demand for modular, adaptable furniture solutions that can be reconfigured with ease.

-

Increased focus on ergonomics, employee wellness & productivity: Office chairs, sit-stand desks, ergonomic storage solutions and health-centric design are winning importance as organisations prioritise occupant comfort and productivity.

-

Sustainability and material innovation: Manufacturers are responding to demand for sustainable furniture—recycled materials, low-VOC finishes, and circular design—opening premium segments and differentiation opportunities.

-

Emerging markets & commercial real estate growth: Regions such as Asia-Pacific are experiencing rapid office construction, corporate expansion and startup growth, therefore increasing furniture consumption.

Together, these drivers provide considerable room for manufacturers, distributors and service-providers to innovate, diversify and capture value beyond basic office furnishings—especially as hybrid work, wellness and sustainability become integral to workspace strategy.

What Lies Ahead: Emerging Trends Shaping the Future

-

Height-adjustable desks & active workstations: As sit-stand and dynamic work behaviours become normalised, demand for adjustable height desks and active seating solutions will grow.

-

Modular, reconfigurable furniture systems: With workplace layouts changing more frequently, furniture that can easily adapt—modular desks, mobile storage, flexible partitions—will gain momentum.

-

Smart furniture & IoT integration: Office furniture embedded with sensors (for occupancy, ergonomics monitoring), connectivity and health-tracking features will become more common in high-end segments.

-

Sustainable and circular economy design: Furniture made using recycled or renewable materials, designed for disassembly, refurbishment or reuse, will become a differentiator as organizations meet ESG targets.

-

Growth of remote/hybrid home-office furniture blurring traditional categories: While the core market is office-based, the expansion of home/hybrid working may create crossover demand and new product categories.

-

Customization & branding of workspaces: Employers are using furniture as part of their brand identity and culture—custom finishes, collaborative zones, wellness areas will shape furniture demand.

Segmentation Analysis

According to the referenced data:

By Product Type: Chairs (seating) dominate revenue share because seating is often the primary concern for ergonomics.

By Material Type: Wood remains a significant share, but metal and recycled composite materials are gaining share due to durability and sustainability trends.

By Distribution Channel: Direct B2B sales to corporate/commercial buyers still dominate, but e-commerce and online channels are increasing rapidly for smaller businesses or modular furniture.

By Application / End-Use: Corporate offices hold the bulk of demand. The growth of co-working, education, banking/finance and government segment also contributes.

By Region: Asia-Pacific leads in share and growth, followed by North America and Europe

Country Level Analysis

-

United States: The U.S. remains a mature market with high spending on ergonomic, premium office furniture, driven by large corporations, technology firms and office build-outs.

-

Germany (Europe): Germany is a strong European market given its manufacturing base, export prowess in furniture, emphasis on design and ergonomics, and stringent workplace standards.

-

India & Asia-Pacific: India, China and other Asia-Pacific economies represent fast-growing markets—rising office space creation, start-up culture, co-working expansion and demand for modern workplace furniture. For example, India’s office furniture market is projected at a CAGR of ~8.8% through 2033.

Commutator (SWOT-Style) Analysis

Strengths

-

Broad global demand driven by workplace construction, refurbishment and hybrid working models.

-

Opportunity to move up the value chain (ergonomic, smart, sustainable furniture) and differentiate from commodity suppliers.

-

Large addressable market and growing segments (co-working, premium, home/hybrid furniture).

Weaknesses

-

Highly competitive market with many regional and local manufacturers, putting pressure on margins.

-

Raw material volatility (wood, metal, foam, textiles) can impact cost structure and profitability.

-

Lead-time and logistics constraints (large bulky products) raise distribution and supply-chain challenges.

Opportunities

-

Premiumization and ergonomic segment growth as firms invest in employee wellbeing and workspace brand identity.

-

Expand into emerging markets and secondary cities where office infrastructure is growing.

-

Offer services beyond product—workspace consultancy, installation, re-configuration, refurbishing, lease models.

-

Sustainability and circular-economy solutions—refurbished furniture, modular reuse—can open new business models and customer segments.

Threats

-

Office space contraction or remote-only work models may reduce demand for traditional office furnishings.

-

Economic slowdowns or real-estate downturns can reduce corporate furniture spending.

-

Press Release Style Conclusion

The office furniture market stands at a pivotal moment. With a global market size of around USD 101.46 billion in 2024 and expectations to reach USD 183.53 billion by 2032 (CAGR ~7.69%), the sector is being reshaped by changing work habits, wellness-centric design, sustainability imperatives and the flexibility of modern workplaces.

For furniture manufacturers, distributors, workspace designers and corporate buyers, the strategic signal is clear: it’s no longer simply about filing cabinets and desks—it’s about enabling agile, healthy, branded, sustainable and digitally-enabled work-environments. Markets in North America and Europe remain important—but rapid expansion in Asia-Pacific, combined with premiumisation and hybrid-workspace furniture formats, provide the greatest upside.

To capture this opportunity, stakeholders must push innovation: ergonomic seating, height-adjustable workstations, modular systems, smart integrated furniture, circular-economy design and service-based models. Equally important is localisation—customising product offerings and services by region, adapting to local supply-chain realities and workplace culture.

In a world where the nature of work is evolving, office furniture is more than furnishing—it is a strategic investment in organisational culture, employee productivity and sustainable futures. The furniture providers that adapt will not only supply chairs and tables—they will help shape how the world works.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness