Getting to Know SAP FICO: A Simple Guide for Beginners

As modern businesses grow more complex, keeping financial operations organized and transparent is critical. That’s where SAP FICO comes into play. A core module of SAP’s ERP suite, SAP FICO helps companies handle their accounting and internal cost control efficiently. If you’re just starting your journey into enterprise systems or finance, this step-by-step guide is a great way to begin learning SAP FICO. SAP FICO Online Training provides a flexible and in-depth way to learn financial accounting and controlling through real-time SAP tools, perfect for beginners and professionals alike.

What is SAP FICO All About?

SAP FICO stands for two important modules within SAP:

-

FI (Financial Accounting): Takes care of a company’s external financial reporting like ledgers, tax statements, and balance sheets.

-

CO (Controlling): Focuses on internal processes such as budgeting, cost control, and performance monitoring.

Together, these two modules give businesses the ability to track, manage, and report both financial transactions and operational costs with accuracy.

Why Should You Learn SAP FICO?

SAP FICO is used by thousands of companies globally, making it one of the most in-demand skills in the finance and ERP domains. Here's why learning it makes sense:

-

It streamlines financial processes and reduces manual errors.

-

It’s widely used across industries manufacturing, retail, healthcare, banking, and more.

-

It integrates tightly with other SAP modules like HR, Sales, and Inventory.

-

It helps businesses get real-time insights into their finances.

Whether you want to become an SAP consultant, work in finance, or manage ERP systems, SAP FICO can boost your career opportunities.

How to Learn SAP FICO: A Step-by-Step Beginner’s Guide

Let’s break down how to approach SAP FICO in a structured and beginner-friendly way.

Step 1: Get Familiar with the SAP System

Before jumping into the FICO module, it’s helpful to understand the overall SAP system:

-

SAP is a business software that helps manage various operations finance, HR, sales, and more.

-

SAP is divided into modules, and FICO is its financial backbone.

-

Learn the basics of the SAP GUI (Graphical User Interface), which is how users interact with the software.

Getting comfortable with navigation will make it easier to learn FICO transactions and processes.

Step 2: Explore Financial Accounting (FI)

The FI module is all about recording and reporting financial data for legal and business needs. Its main components include:

-

General Ledger (G/L): The primary place where all accounting entries are recorded.

-

Accounts Payable (AP): Tracks what the company owes to its vendors.

-

Accounts Receivable (AR): Manages money owed to the company by customers.

-

Asset Accounting: Maintains records of assets like equipment and their depreciation.

-

Bank Accounting: Deals with bank transactions and cash flow reconciliation.

Understanding these features will help you grasp how businesses manage and report their finances externally.

Step 3: Learn the Basics of Controlling (CO)

The CO module supports internal cost management and performance evaluation. Here are some of its essential elements:

-

Cost Elements: Used to classify expenses and income.

-

Cost Centers: Departments or units where costs are tracked (e.g., HR or production).

-

Profit Centers: Business segments that are responsible for generating revenue.

-

Internal Orders: Temporary structures for tracking project costs.

-

Activity-Based Costing: Helps assign overhead costs more accurately to services or products.

CO helps companies stay efficient by analyzing how their resources are being used.

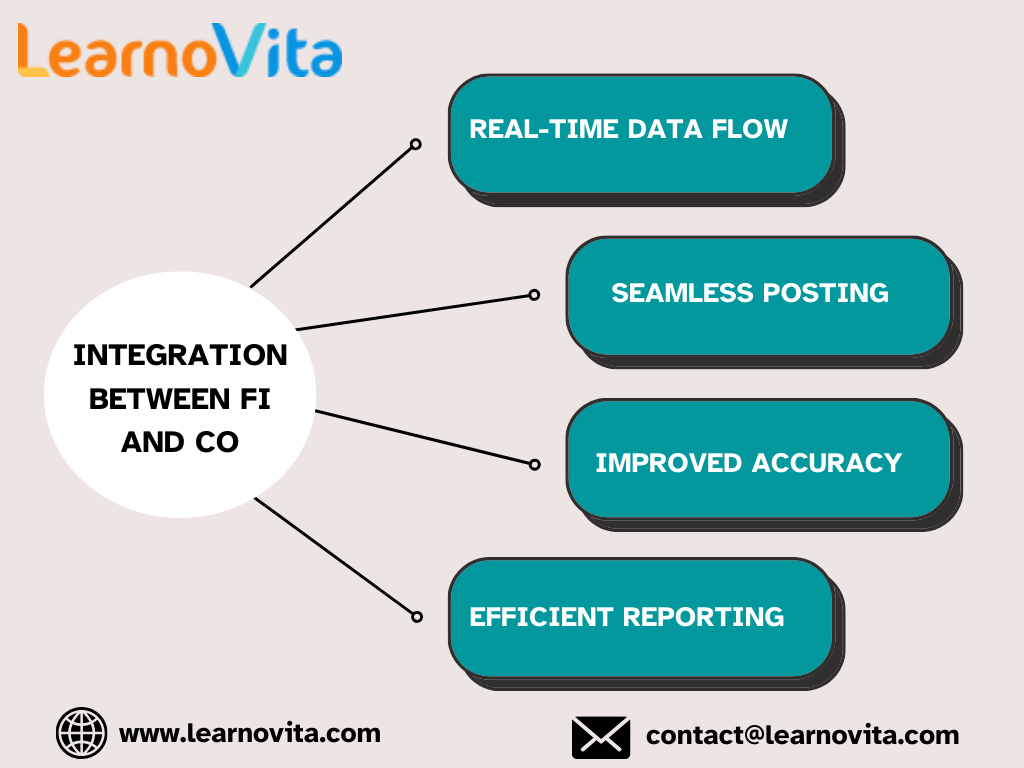

Step 4: Understand How FI and CO Work Together

The beauty of SAP FICO is its seamless integration:

-

When a sales order is created, revenue is recorded in FI, and profit tracking occurs in CO.

-

Employee payroll, handled by the HR module, posts expenses to both FI and CO.

-

Purchase orders from the materials module update both vendor balances and cost tracking.

This connectivity ensures all business processes remain synchronized and accurate. Our Best Training & Placement Program ensures hands-on learning and career support, guiding you from skill-building to securing your dream job.

Step 5: Learn Key Transaction Codes

In SAP, every function is accessed through a transaction code (T-code). Here are a few common ones used in FICO:

-

FB50: Post general ledger transactions.

-

F-02: Enter journal entries manually.

-

F110: Automate vendor payments.

-

FS00: Set up general ledger accounts.

-

KP06: Input cost center budgets.

-

KE51: Create profit centers.

Regular practice using these codes is essential for building confidence with the system.

Step 6: Dive into Configuration Basics

Once you’re comfortable with using SAP, you can start exploring how to configure it. SAP allows companies to tailor the system to their unique structure and policies. Key configuration tasks include:

-

Creating company codes, fiscal years, and charts of accounts.

-

Setting up posting periods, document types, and tax codes.

-

Defining internal control structures and workflows.

If you’re aiming to become a functional consultant, configuration is a must-have skill.

Step 7: Learn to Use FICO Reports

SAP FICO provides a wide range of reports for both internal and external analysis. These include:

-

Balance Sheets

-

Profit & Loss Statements

-

Trial Balances

-

Accounts Payable and Receivable Aging Reports

-

Cost Center and Profit Center Reports

Being able to generate and interpret these reports will allow you to provide real-time insights that support business decisions.

Step 8: Practice and Work Toward Certification

The best way to gain expertise in SAP FICO is through hands-on practice. Here's how:

-

Use a demo SAP system or training environment.

-

Enroll in SAP FICO courses that include practical exercises.

-

Work toward official SAP certification to validate your skills.

-

Explore the latest version SAP S/4HANA FICO which offers an improved, simplified financial experience.

Practice and certification together can prepare you for roles in SAP projects or finance teams.

Wrapping Up

SAP FICO is an essential part of modern business finance. It helps companies stay compliant, manage their finances effectively, and make better decisions. While it may seem complex at first, learning SAP FICO becomes much easier when you follow a step-by-step approach starting from system basics and moving into accounting, cost control, configuration, and reporting. If you're looking to grow in finance, ERP, or consulting, developing SAP FICO skills can be one of the smartest moves you make.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness