How Offshore Bookkeepers Streamline Operations for Modern Businesses

In today’s fast-paced business environment, efficiency is everything. Companies that can simplify processes, cut unnecessary costs, and make quick, data-driven decisions gain a significant competitive edge. One area where businesses often face bottlenecks is financial management—especially bookkeeping.

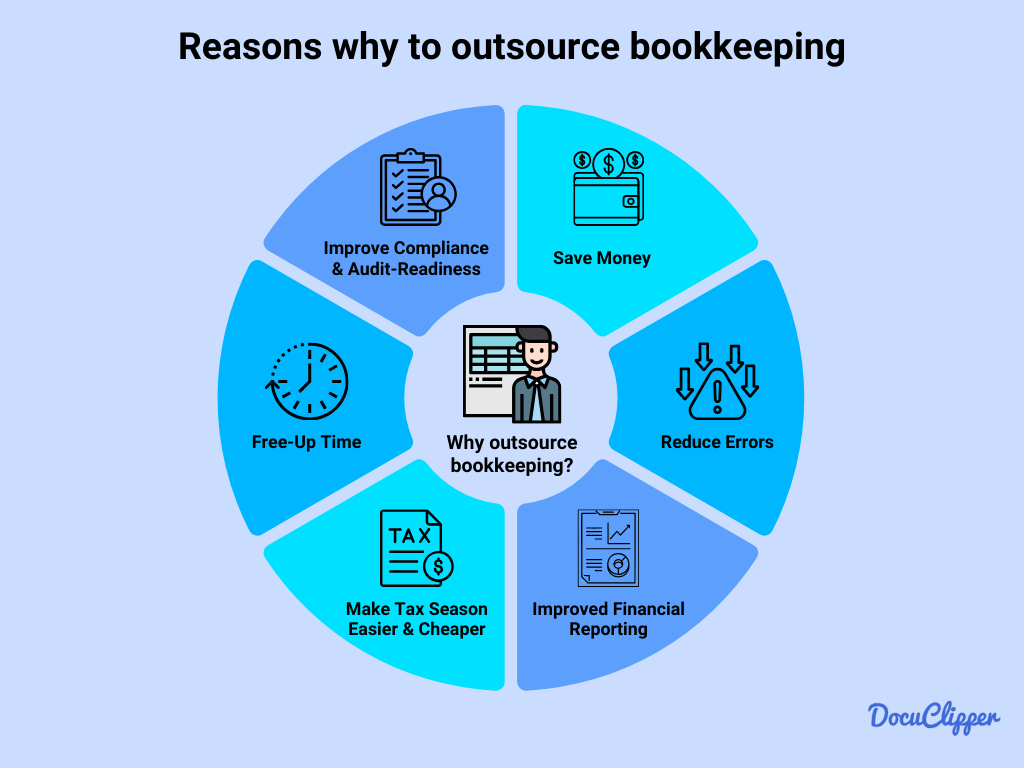

Handling bookkeeping in-house can be time-consuming, costly, and prone to delays, particularly for small and mid-sized businesses trying to scale. That’s why more companies are turning to offshore bookkeepers to streamline their operations, boost efficiency, and stay ahead in a rapidly evolving marketplace.

Here’s how offshore bookkeepers help modern businesses simplify financial management while saving time and money.

1. Reducing Administrative Burdens

Bookkeeping involves numerous routine tasks, including:

-

Reconciling bank and credit card statements

-

Processing accounts payable and receivable

-

Managing payroll

-

Tracking expenses

-

Preparing financial reports for management and tax season

While essential, these tasks don’t directly contribute to growth or revenue. Offshore bookkeepers take over these responsibilities, freeing internal teams from repetitive administrative work.

By outsourcing, businesses can redirect their staff’s focus toward core functions like sales, customer service, and innovation—areas that actually drive growth.

2. Lowering Costs Without Compromising Quality

For many businesses, maintaining an in-house bookkeeping team can be expensive. Salaries, benefits, payroll taxes, training, and software subscriptions add up quickly. Even outsourcing to local firms can come with high hourly rates.

Offshore bookkeepers offer a cost-effective alternative, delivering skilled financial support at 40–60% lower costs than hiring locally. These professionals are trained in global accounting standards and proficient in tools like QuickBooks, Xero, and Zoho Books, ensuring accuracy and efficiency without the high price tag.

The money saved can be reinvested into growth initiatives—marketing campaigns, hiring sales staff, or product development—helping businesses expand faster.

3. Offering Scalability for Changing Workloads

Financial workloads often fluctuate throughout the year. Tax season, audits, and periods of rapid growth can overwhelm internal teams, while slower periods leave staff underutilized.

Offshore bookkeeping services solve this challenge by offering scalable support. Businesses can easily ramp up services during busy times and scale back when things slow down, paying only for what they need.

This flexibility keeps operations lean and efficient, helping companies avoid the costs and complexities of hiring temporary or full-time staff to manage fluctuating workloads.

4. Providing 24/7 Productivity

Time zone differences are a significant advantage when working with offshore bookkeepers. While your local team finishes their day, your offshore team continues working—reconciling accounts, processing transactions, and preparing reports overnight.

By the time you start your workday, your financials are updated and ready for review. This around-the-clock productivity keeps operations moving smoothly and reduces delays in financial reporting and decision-making.

5. Enhancing Accuracy and Reducing Errors

Bookkeeping errors—whether from overworked staff, missed entries, or rushed reconciliations—can lead to costly problems, from financial mismanagement to tax penalties. Offshore bookkeeping firms typically employ teams of trained professionals who use standardized processes and internal quality checks to ensure accuracy.

This systematic approach reduces the risk of errors, ensuring your books remain audit-ready and compliant with regulations year-round.

6. Delivering Real-Time Financial Insights

Modern offshore bookkeeping providers use cloud-based accounting software, allowing businesses to:

-

Access financial data anytime, anywhere

-

Monitor cash flow and expenses in real time

-

Review reconciliations and reports as they’re completed

-

Collaborate easily with the offshore team

This real-time visibility empowers business owners and managers to make faster, data-driven decisions, from adjusting budgets to seizing new growth opportunities, without waiting for end-of-month reports.

7. Freeing Leaders to Focus on Growth

When business leaders and managers spend hours on bookkeeping tasks, they lose valuable time that could be used for strategic work. By outsourcing to offshore bookkeepers, companies can free their leadership team to:

-

Develop new revenue streams

-

Strengthen client and customer relationships

-

Explore expansion opportunities

-

Improve operational processes

Shifting focus from administrative work to growth initiatives allows businesses to operate more efficiently and profitably.

8. Supporting Compliance and Tax Readiness

Tax season and audits often create chaos for businesses that haven’t kept their books consistently updated. Offshore bookkeepers ensure that financial records remain accurate, organized, and up to date throughout the year.

This proactive approach simplifies compliance, reduces last-minute scrambling, and helps avoid costly penalties—streamlining operations when it matters most.

9. Providing Reliable, Continuous Support

Depending solely on one or two in-house bookkeepers creates risk. If an employee takes time off, becomes ill, or leaves, financial processes can grind to a halt. Offshore bookkeeping providers operate with teams, ensuring uninterrupted service even when individual staff members change.

This reliability allows businesses to maintain consistent financial management and avoid operational slowdowns.

10. Leveraging Advanced Security and Technology

Modern offshore bookkeeping firms invest heavily in secure systems and data protection protocols, including encrypted file transfers and compliance with international data privacy standards like GDPR.

Often, their technology and security measures surpass what small and mid-sized businesses could afford on their own, giving companies enterprise-level protection for sensitive financial information.

Final Thoughts

For modern businesses, efficiency isn’t optional—it’s essential. Offshore bookkeepers help streamline operations by reducing administrative burdens, lowering costs, ensuring accuracy, and providing scalable, round-the-clock support. They also deliver the real-time financial insights leaders need to make smarter decisions and stay competitive.

By partnering with offshore bookkeepers, companies can operate leaner, move faster, and focus on growth, all while keeping their finances accurate, secure, and compliant.

If your business is looking to simplify operations and boost efficiency, offshore bookkeeping may be the key to staying competitive in today’s fast-moving marketplace.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness