Data-Driven Finance: The Future of Financial Services

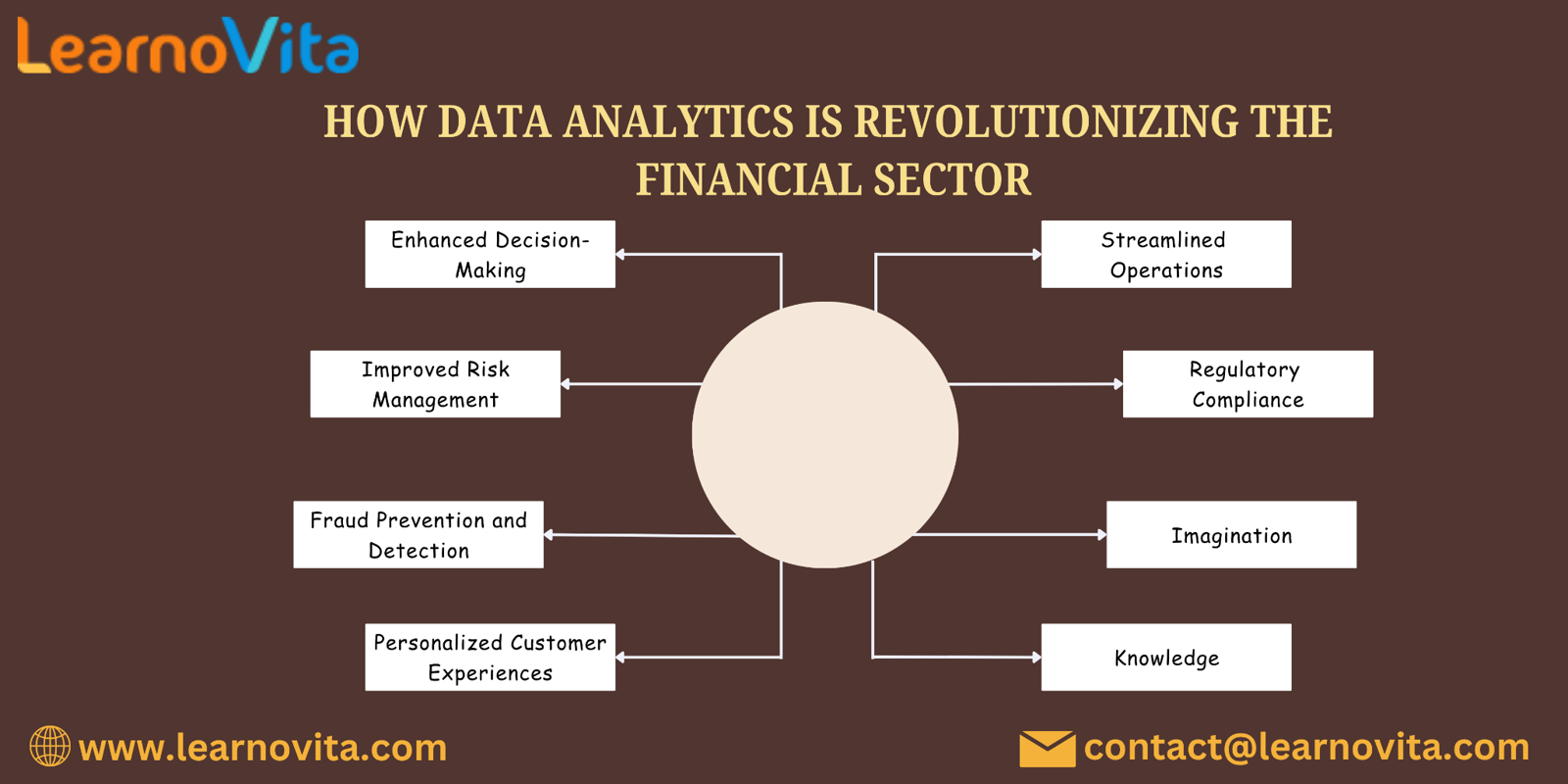

As we move deeper into the digital age, the financial services industry is experiencing a profound transformation driven by data. Data-driven finance is not just a trend; it represents the future of financial services, reshaping how organizations operate, make decisions, and serve their clients. In this blog, we explore the key aspects of this transformation and what it means for the future of finance.

For those looking to enhance their skills, Data Analytics Course in Bangalore programs offer comprehensive education and job placement assistance, making it easier to master this tool and advance your career.

1. The Rise of Big Data

The volume of data generated today is unprecedented, creating a wealth of information for financial institutions to analyze. Big data analytics allows organizations to sift through vast amounts of information, extracting valuable insights that inform strategic decision-making. This capability enhances risk assessment, customer understanding, and operational efficiency, setting the stage for a more informed financial landscape.

2. Enhanced Customer Experiences

Data-driven finance places the customer at the center of financial services. By leveraging analytics, organizations gain deep insights into customer behaviors, preferences, and needs. This understanding enables financial institutions to tailor their products and services, offering personalized solutions that enhance customer satisfaction and loyalty. The result is a more engaging and relevant customer experience.

3. Predictive Analytics for Proactive Strategies

Predictive analytics is revolutionizing how financial institutions approach risk management and investment strategies. By analyzing historical data and market trends, organizations can forecast potential risks and opportunities. This proactive approach allows financial services to respond swiftly to market fluctuations, ensuring they remain competitive and resilient in an ever-changing environment.

4. Streamlined Operations and Cost Efficiency

Operational efficiency is crucial in the financial sector. Data-driven strategies help organizations identify inefficiencies in processes and workflows, enabling them to streamline operations. By automating routine tasks and optimizing resource allocation, financial institutions can reduce costs and improve productivity, ultimately enhancing their bottom line.

5. Real-Time Decision-Making

In a fast-paced financial environment, the ability to make real-time decisions is essential. Data analytics provides instant access to critical information, allowing organizations to respond quickly to changing market conditions. This agility is vital for capitalizing on emerging opportunities and managing risks effectively.

With the aid of Data Analytics Certification Course programs, which offer comprehensive training and job placement support to anyone looking to develop their talents, it’s easier to learn this tool and advance your career.

6. Strengthened Compliance and Risk Management

Compliance with regulatory requirements is a significant challenge for financial institutions. Data-driven finance simplifies compliance tracking and reporting, ensuring that organizations adhere to regulations efficiently. By automating compliance processes, financial services can minimize the risk of penalties and maintain transparency and accountability.

7. Innovation and New Business Models

Data-driven finance fosters a culture of innovation within financial institutions. By leveraging advanced analytics, organizations can explore new business models, improve existing products, and develop cutting-edge solutions. This innovative mindset not only enhances competitiveness but also positions financial institutions as leaders in their industry.

8. Competitive Advantage in a Crowded Market

In a highly competitive landscape, leveraging data analytics can provide a significant edge. Financial institutions that embrace data-driven strategies are better equipped to understand market dynamics, anticipate customer needs, and outmaneuver competitors. This competitive advantage can lead to increased market share and profitability.

Conclusion

Data-driven finance is not just the future; it is the present shaping the financial services industry. As organizations continue to harness the power of data, they are better positioned to navigate challenges, seize opportunities, and deliver exceptional value to their clients. Embracing data analytics is essential for success in the modern financial landscape, and those who lead in this transformation will define the future of financial services.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness