Automotive Infotainment Market Dynamics and Competitive Landscape 2025-2032

Automotive Infotainment Market Size, Share, Growth, and Trends (2025–2032)

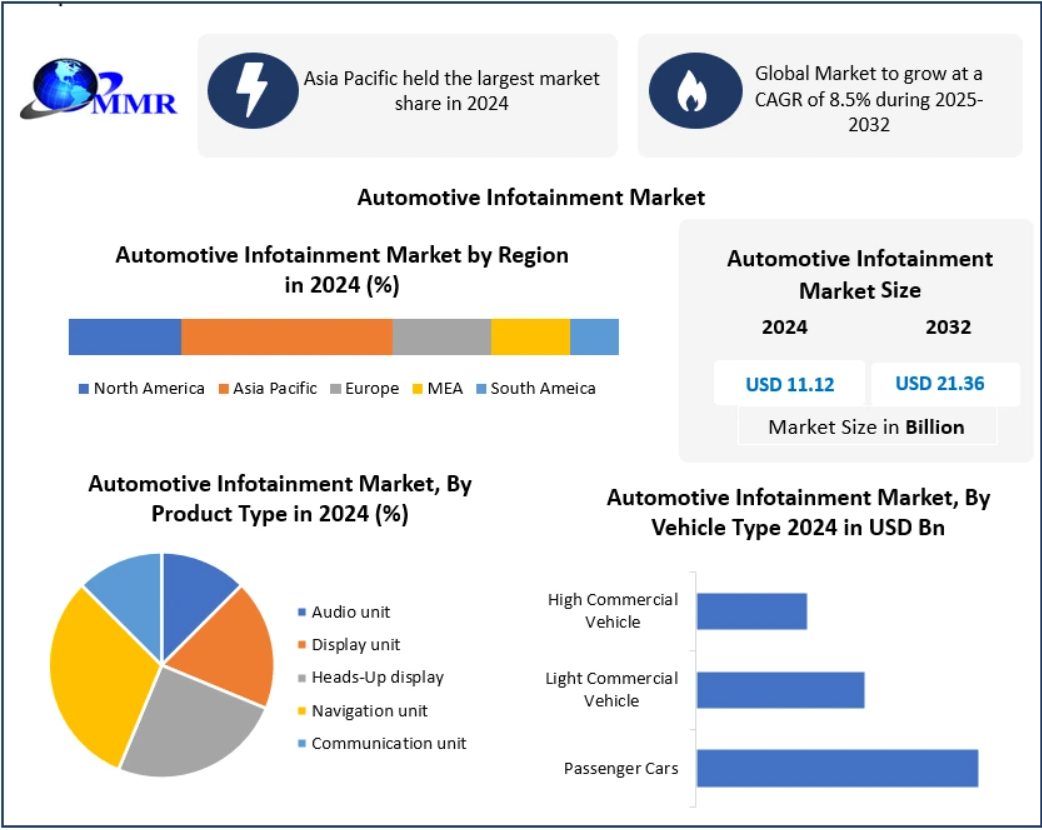

The Automotive Infotainment Market was valued at USD 11.12 billion in 2025, and it is projected to reach USD 21.36 billion by 2032, growing at a CAGR of 8.5% during the forecast period. Automotive infotainment systems integrate entertainment, navigation, and communication solutions in vehicles, offering seamless connectivity and enhancing the overall driving experience. These systems feature touchscreen displays, GPS navigation, Bluetooth, Wi-Fi, 5G connectivity, and smartphone integration, providing access to multimedia content, calls, and apps.

Automotive Infotainment Market Overview

Infotainment systems are becoming the central hub for connected vehicles, integrating smart automotive technologies such as ADAS, V2X connectivity, telematics devices, and IoT solutions. They enable a personalized driving experience through AI-driven content recommendations, voice recognition, and gesture control.

Popular operating systems such as QNX and Linux are widely used for developing robust infotainment platforms. While QNX offers high reliability, customizable HMI, and HD communications, its cost is high, making Linux a growing alternative. The demand is fueled by smartphone integration, allowing users seamless access to applications and services directly within the vehicle.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/54858/

Market Dynamics

Key Drivers

- Advancements in Connectivity – Integration of Wi-Fi, Bluetooth, and 5G networks enables real-time navigation, streaming, OTA updates, and remote vehicle monitoring.

- Personalized Infotainment Experiences – AI and ML are increasingly used to customize content based on driver behavior and preferences.

- Integration with ADAS – Infotainment systems now link with safety features such as collision avoidance, lane departure alerts, and adaptive cruise control, enhancing driver safety and convenience.

- Rising Smartphone Penetration – Smartphones act as a bridge for infotainment, driving demand for seamless in-car connectivity.

Opportunities

- 5G and IoT integration will transform cars into part of a connected digital ecosystem.

- Growing demand for immersive in-car experiences such as AR-based heads-up displays, gaming, ambient lighting, and wellness apps.

- Increasing adoption in luxury and mid-segment vehicles, especially in emerging markets.

Restraints

- High costs of advanced infotainment systems.

- Compatibility issues across platforms and fragmented ecosystems.

- Cybersecurity risks leading to consumer concerns.

- Regulatory and safety compliance requirements.

Segment Analysis

By Product Type

- Navigation Units – Dominated the market in 2024 with 38.1% share, driven by advanced features like 3D maps, hands-free calling, and satellite radio.

- Heads-Up Displays (HUDs) – Expected to register the fastest growth due to AR integration, offering real-time speed, navigation, and safety alerts projected onto windshields.

- Communication Units – Increasing adoption with 5G for real-time connectivity.

By Fit Type

- OEM-Fitted Systems (73% share in 2024) – Preferred due to warranty coverage, low maintenance, and integration during vehicle production.

- Aftermarket Systems – Expected to grow rapidly, offering customization and affordability compared to OEM solutions.

By Vehicle Type

- Passenger Cars – Largest segment due to rising adoption of premium infotainment features.

- Light & Heavy Commercial Vehicles – Increasing demand for navigation, fleet management, and safety features.

Regional Insights

- Asia Pacific (40.9% share in 2023) – Leading region, driven by rising passenger car sales, EV adoption, and growing disposable incomes. Countries like China, India, and Japan are major contributors.

- Europe – Strong presence of leading automakers and tech collaborations. Adoption of cloud technology in vehicles is a key growth driver.

- North America – Growth supported by luxury vehicle demand, premium infotainment systems, and advanced tech adoption.

- Middle East & Africa / South America – Emerging opportunities due to growing automotive sales and interest in connected vehicles.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/54858/

Key Players in the Automotive Infotainment Market

North America

- Harman International (US)

- Pioneer Electronics (US)

- Visteon Corporation (US)

- Bose Corporation (US)

Asia Pacific

- DENSO Corporation (Japan)

- Panasonic Corporation (Japan)

- Alpine Electronics, Inc. (Japan)

- KENWOOD Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- AISIN SEIKI Co., Ltd. (Japan)

- ALLGo Embedded Systems Pvt Ltd (India)

Europe

- Garmin Ltd (Switzerland)

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- Blaupunkt (Germany)

- Magneti Marelli S.p.A. (Italy)

- TomTom International BV (Netherlands)

- Delphi Automotive PLC (UK)

Conclusion

The Automotive Infotainment Market is undergoing rapid transformation, driven by connectivity advancements, AI integration, and growing demand for in-car experiences. With ADAS integration, AR displays, and 5G-enabled systems, infotainment is evolving from an entertainment unit to a safety, communication, and control hub for connected vehicles. While challenges like costs, cybersecurity, and compatibility remain, opportunities in IoT, EV adoption, and personalized entertainment make this sector a key growth area for the automotive industry.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness