Wi-Fi 6 Chip Market: Share, Size, Forecast and Dynamics, 2025–2032

Wi-Fi 6E Chip Market, Trends, Business Strategies 2025-2032

Download Sample Report PDF https://semiconductorinsight.com/download-sample-report/?product_id=107245

MARKET INSIGHTS

The global Wi-Fi 6E Chip Market size was valued at US$ 2,890 million in 2024 and is projected to reach US$ 8,940 million by 2032, at a CAGR of 17.3% during the forecast period 2025-2032. This growth is fueled by the increasing adoption of high-speed internet connectivity and the proliferation of smart devices across industries.

Wi-Fi 6E chips are advanced semiconductor components that enable wireless communication over the 6 GHz frequency band, offering lower latency, higher bandwidth, and improved network efficiency compared to previous Wi-Fi standards. These chips are critical for next-generation applications requiring ultra-fast data transfer, including augmented reality (AR), 4K/8K video streaming, and industrial IoT deployments.

The market expansion is driven by rising demand for seamless connectivity in smart homes, enterprises, and automotive applications. While the semiconductor industry faced challenges in 2022 with a growth slowdown to 4.4% (USD 580 billion market size), the wireless communication segment continues to show resilience. Leading manufacturers like Broadcom, Qualcomm, and Intel are investing heavily in Wi-Fi 6E technology to capitalize on the growing need for high-performance networking solutions in an increasingly connected world.

MARKET DYNAMICS

The industrial sector represents one of the most promising opportunities for Wi-Fi 6E adoption. Factory automation systems demand reliable, high-throughput wireless connectivity with deterministic latency below 10ms—a requirement perfectly aligned with Wi-Fi 6E capabilities. Early implementations in smart manufacturing facilities demonstrate 60-70% reductions in communication latency compared to wired alternatives while maintaining five-nines reliability. The ability to support real-time control of robotic systems and AR-assisted maintenance applications positions Wi-Fi 6E as a transformative technology for Industry 4.0 implementations. Market projections indicate industrial applications could account for over 25% of Wi-Fi 6E chip revenues by 2027.

Gaming and XR Ecosystems Drive Premium Consumer Adoption

The consumer gaming market presents a significant opportunity for Wi-Fi 6E, with next-generation consoles and XR headsets demanding more bandwidth than current networks can provide. Cloud gaming platforms require consistent sub-20ms latency to deliver high-quality experiences—a benchmark regularly exceeded by Wi-Fi 6E in controlled tests. Major gaming peripheral manufacturers have begun integrating Wi-Fi 6E capabilities into premium products, with early adopters reporting 2-3 times faster response times in competitive multiplayer environments. As AAA game titles increasingly incorporate VR elements and real-time ray tracing, the performance advantages of Wi-Fi 6E will become increasingly compelling for hardcore gamers.

Integration with 5G Networks Creates Convergence Opportunities

The convergence of Wi-Fi 6E and 5G networks presents substantial growth opportunities for chip manufacturers. Network operators are increasingly deploying architectures that intelligently switch between cellular and Wi-Fi based on application requirements and network conditions. Wi-Fi 6E’s performance characteristics make it particularly suitable for handling data-intensive tasks in these hybrid networks, reducing strain on cellular infrastructure. Several major carriers have begun trials of converged 5G/Wi-Fi 6E solutions that could redefine indoor wireless coverage. This convergence trend is expected to drive demand for multi-mode chipsets that can optimize traffic across both network types.

List of Key Wi-Fi 6E Chip Manufacturers

- Qualcomm Technologies, Inc. (U.S.)

- Broadcom Inc. (U.S.)

- Intel Corporation (U.S.)

- NXP Semiconductors N.V. (Netherlands)

- MediaTek Inc. (Taiwan)

- Texas Instruments Incorporated (U.S.)

- ON Semiconductor Corporation (U.S.)

- Qorvo, Inc. (U.S.)

- Microchip Technology Inc. (U.S.)

Segment Analysis:

By Type

6 GHz Band Segment Poised for Rapid Growth Due to Unlicensed Spectrum Availability

The Wi-Fi 6E chip market is segmented based on frequency band types into:

- 2.4 GHz

- Subtypes: Legacy Wi-Fi (802.11b/g/n) compatible chips

- 5 GHz

- 6 GHz

- Subtypes: Tri-band (2.4/5/6 GHz) and dual-band (5/6 GHz) configurations

By Application

Consumer Electronics Segment Leads Due to High Adoption in Smartphones and Laptops

The market is segmented based on application into:

- Industrial Internet of Things (IIoT)

- Automotive

- Consumer Electronics

- Subtypes: Smartphones, laptops, tablets, gaming consoles

- Household Appliances

- Others

By End User

Enterprise Sector Adopting Wi-Fi 6E for High-Density Environments

The market is segmented based on end users into:

- Residential

- Enterprise

- Subtypes: Offices, education, healthcare facilities

- Service Providers

By Architecture

Integrated SoCs Gaining Traction for Compact Device Designs

The market is segmented based on chip architecture into:

- Discrete Chipsets

- Integrated SoCs

- Modular Solutions

Regional Analysis: Wi-Fi 6E Chip Market

North America

As the leading market for Wi-Fi 6E technology, North America benefits from rapid adoption driven by early regulatory approval (FCC allocated the 6GHz band in 2020) and strong demand for high-speed connectivity. The region accounted for over 40% of global Wi-Fi 6E chip sales in 2023, with the US dominating due to enterprise infrastructure upgrades and consumer adoption of 6GHz-enabled routers. Major tech hubs like Silicon Valley and the presence of chip designers (Qualcomm, Broadcom, Intel) accelerate innovation. However, supply chain constraints continue affecting production timelines, while price sensitivity in consumer markets may slow widespread adoption.

Europe

Europe’s Wi-Fi 6E chip market grows steadily under supportive EU policies, though delayed spectrum allocation in key nations until 2023 created initial barriers. Germany and the UK lead regional adoption, with industrial IoT applications driving 30% year-over-year growth in chip demand. Strict data security laws push development of specialized enterprise solutions, while consumer adoption lags due to higher device costs. Competition from wired alternatives in commercial settings remains a challenge, though upcoming smart city projects in Barcelona, Berlin, and Amsterdam present significant opportunities.

Asia-Pacific

The fastest-growing Wi-Fi 6E market, Asia-Pacific shows divergent trends: While Japan and South Korea lead in early adoption (with government-backed 6GHz trials since 2021), China’s delayed spectrum approval limits growth despite massive manufacturing capacity. India emerges as a wildcard with projected 45% CAGR through 2030, fueled by digital infrastructure projects. Price competition from domestic chipmakers pressures global suppliers, while smartphone OEMs increasingly integrate 6E capabilities in premium models across Southeast Asia. Infrastructure gaps in rural areas may delay nationwide implementation.

South America

Market development remains in early stages, with Brazil and Chile making progressive spectrum allocations in 2023-24. Economic instability limits consumer adoption, though enterprise demand grows for industrial and agricultural IoT applications where wired solutions are impractical. Regional chip sales currently represent under 5% of global volume, but partnerships between telecom providers and equipment manufacturers signal long-term potential. Infrastructure challenges and import dependency continue restraining faster growth across most nations.

Middle East & Africa

The niche market shows promise in Gulf states (UAE, Saudi Arabia) where smart city initiatives drive early 6GHz deployments. Special economic zones utilize Wi-Fi 6E for high-density commercial applications, though consumer adoption remains minimal. Africa’s growth hinges on improving baseline connectivity – while South Africa and Nigeria test 6GHz applications, most nations prioritize fundamental network expansion. Chip sales currently focus on enterprise-grade equipment imports, with projected growth accelerating post-2025 as regional infrastructure matures.

Download Sample Report PDF https://semiconductorinsight.com/download-sample-report/?product_id=107245

Related Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

[email protected]

Kategoriler

Read More

Quand une urgence dentaire survient, chaque seconde compte. Une douleur lancinante, une dent ébréchée ou une blessure soudaine peut bouleverser votre journée. Si vous êtes à Genève et cherchez une "clinique dentaire urgence Genève", vous n'êtes pas seul. Les urgences dentaires sont plus fréquentes qu'on ne le pense, et...

The world of ecommerce continues to grow rapidly, and Amazon has established itself as the leading platform for online sellers. To succeed as an Amazon seller, one of the most crucial factors is finding reliable wholesale suppliers. When it comes to the US market, searching for trusted usa wholesale suppliers amazon can make all the difference in building a sustainable and profitable...

Middle East and Africa Audio Critical Communication Market, By Product Type (Hardware and Services), Connectivity (Wireless and Wired), End-Use (Public Safety, Transportation, Mining, Utilities and Others) – Industry Trends and Forecast to 2029. Data Bridge Market Research analyses that the audio critical communication market is expected to reach the value of USD 1,273.64 million by...

Cultural entertainment Qatar has evolved into a powerful medium for connecting communities, celebrating heritage, and enriching events across the region. At the heart of this cultural revolution is Candela Entertainment, a premier event management and artist booking agency based in Doha. Since 2008, Candela has been dedicated to bringing Qatar’s rich traditions and modern...

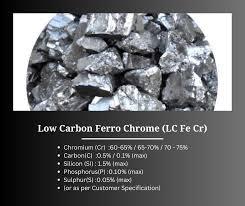

India’s industrial growth and infrastructure expansion have consistently driven demand for specialty alloys. Among them, Low Carbon Ferro Chrome (LC FeCr) plays a pivotal role in the production of stainless steel, heat-resistant steels, and other alloy steels. With India's rapidly growing metallurgical and manufacturing sectors, the domestic production of LC FeCr has gained strategic...