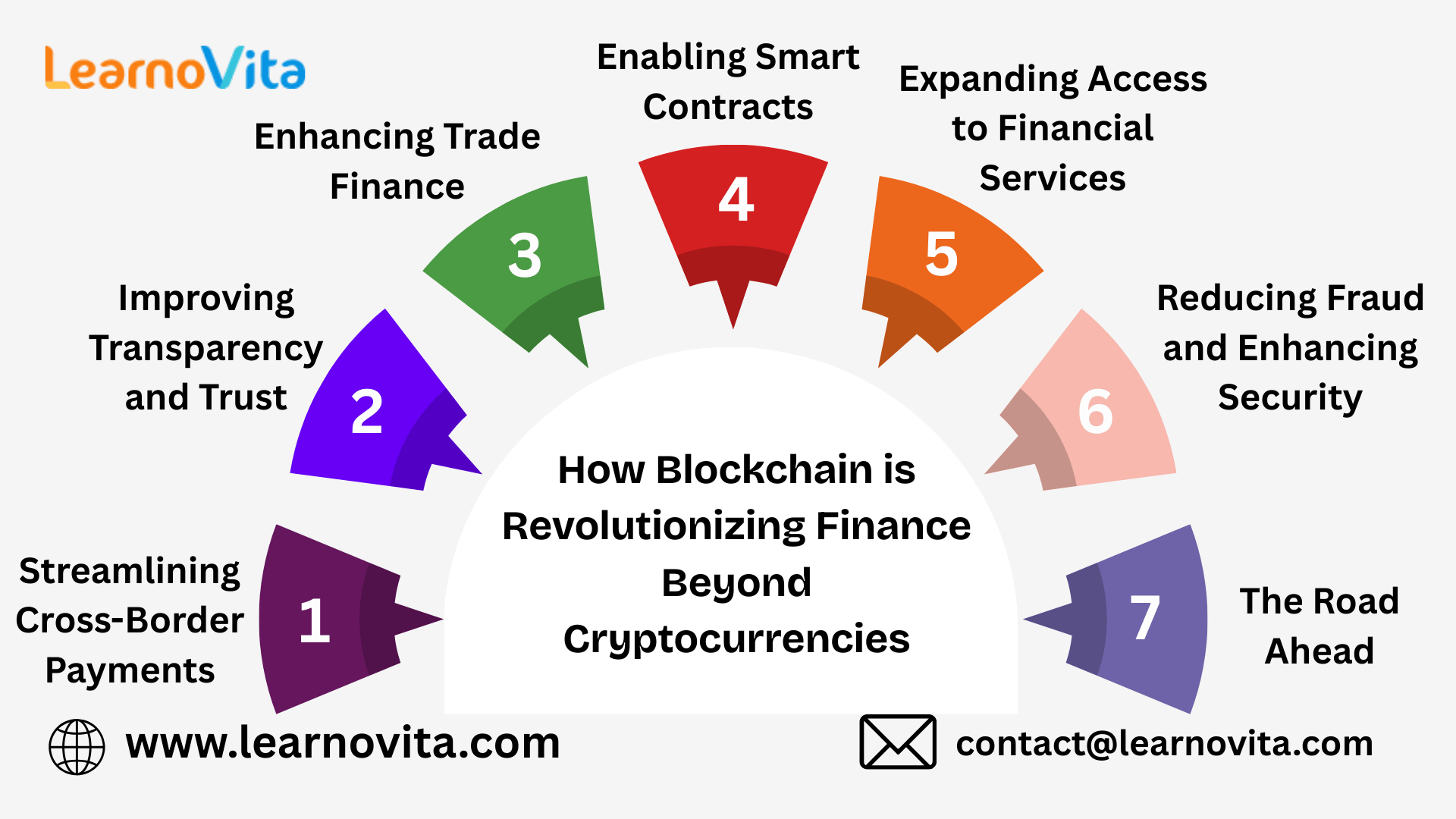

Why Blockchain Matters More Than Just Cryptocurrency in Finance

When blockchain first emerged, it was almost impossible to talk about it without mentioning Bitcoin. For years, the technology was tied to the rise and fall of cryptocurrencies. But quietly, Blockchain Online Course has been growing into something far bigger. Today, it’s reshaping the very foundation of the financial world changing how money moves, how deals are made, and how trust is built.

1. Rethinking Global Payments

Imagine sending money abroad and having it arrive within minutes instead of days. That’s the power blockchain brings to cross-border payments. Traditional transfers crawl through layers of banks, each taking a fee and slowing the process. Blockchain cuts through that maze by connecting sender and receiver directly. Faster, cheaper, and more reliable this is the new face of international finance.

2. Trust Through Transparency

Finance has always relied on trust, but trust has often been placed in intermediaries banks, clearinghouses, or auditors. Blockchain flips that model. Every transaction is recorded on a shared, tamper-proof ledger that anyone with permission can verify. This transparency means fewer disputes, less fraud, and a system where trust comes not from middlemen, but from the technology itself.

3. Untangling Trade Finance

If there’s one area of finance that desperately needs modernization, it’s trade finance. Moving goods across borders usually requires mountains of paperwork letters of credit, bills of lading, customs documents. Mistakes are common, delays are costly, and everyone is left frustrated. Blockchain offers a smarter way by digitizing these records and making them instantly accessible to all parties. The result? Faster approvals, lower costs, and smoother global trade.

4. Smarter Contracts, Smarter Finance

Contracts are the lifeblood of finance, but they often involve lengthy negotiations and manual enforcement. Enter Software Training Institute smart contracts blockchain-based agreements that execute automatically once conditions are met. Think of an insurance payout triggered the second a verified event occurs, like a delayed flight. No back-and-forth, no red tape, just instant action. This automation saves time, money, and headaches.

5. Opening Doors for the Unbanked

Not everyone has access to traditional banking, especially in developing regions. Blockchain is changing that. With decentralized finance (DeFi), people can borrow, lend, or invest directly through blockchain platforms no bank required. This financial inclusion could give millions the tools to grow businesses, save securely, and participate in the global economy.

6. Fighting Fraud and Cybercrime

Financial crime is an ever-present threat. Blockchain’s decentralized structure and strong cryptographic protections make it far more secure than many legacy systems. Whether it’s preventing identity theft or protecting payment data, blockchain reduces vulnerabilities and helps safeguard both institutions and individuals.

7. Looking Ahead

The future of finance is being rewritten. Central banks are exploring their own digital currencies, global banks are piloting blockchain-powered settlement systems, and startups are creating new ways to borrow, trade, and invest. Challenges like regulation and scalability remain, but the momentum is undeniable.

Conclusion

Blockchain is no longer just about cryptocurrencies it’s about transforming finance itself. By speeding up payments, strengthening trust, simplifying trade, and expanding access, blockchain is laying the groundwork for a financial system that is faster, fairer, and more secure. The revolution is already underway.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness