Europe Oral Care Market to be Driven by increasing population in the Forecast Period of 2025-2032

Europe Oral Care Market: From Hygiene Necessity to High-Value Wellness Category

Request Free Samhttps://www.stellarmr.com/report/req_sample/Europe-Oral-Care-Market/2280 ple Report:

1. Market Estimation & Definition

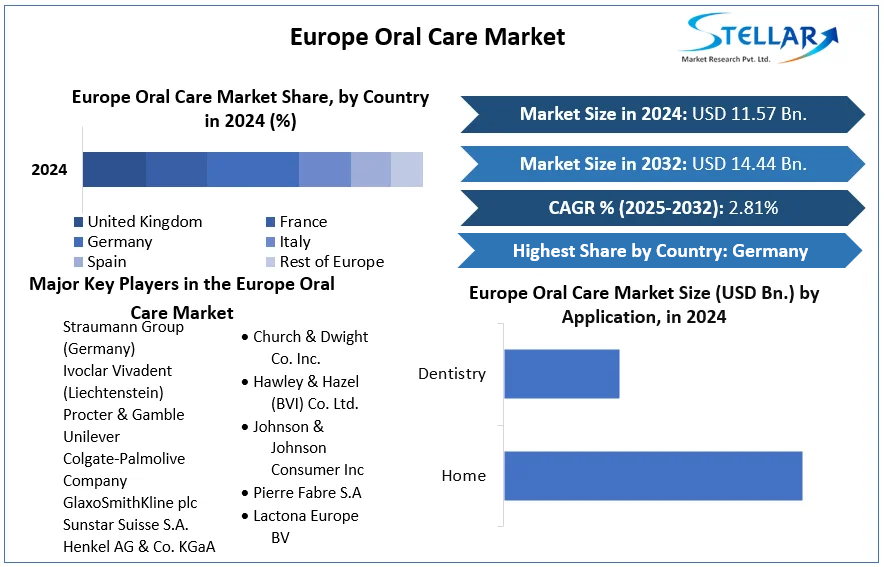

The Europe oral care market was valued at approximately USD 11.57 billion in 2024 and is projected to grow to USD 14.44 billion by 2032, registering a CAGR of about 2.81 % over the forecast period.

Oral care refers broadly to products and practices intended to maintain oral hygiene, prevent dental diseases (such as caries, gum disease, periodontitis), and support overall dental wellness. Key product categories include toothpaste, toothbrushes (manual and electric), mouthwashes/rinses, denture products, dental accessories, and other oral hygiene-related items.

In Europe, the oral care category has moved beyond basic hygiene: consumers now increasingly view it as part of personal care, wellness and even lifestyle. Accordingly, product innovation, premiumisation and channel disruption are playing key roles.

2. Market Growth Drivers & Opportunity

Several inter-linked drivers are fueling growth and presenting opportunities in the European oral care market:

Increasing prevalence of oral health issues

In Europe, a large proportion of the adult population is affected by gum disease (periodontitis), cavities and other oral disorders. For instance, in the EU, more than 50 % of individuals may suffer from some form of gum disease, with the incidence rising to 70-85 % in those aged 60-65 years. The rising incidence of these conditions highlights the need for preventive oral care and supports demand for specialised products (e.g., anti-sensitivity toothpastes, whitening formulas, therapeutic mouthwashes).

Growing consumer awareness and preventive mindset

Consumers in Europe are increasingly educated about oral health, hygiene practices and their link to general health. This has elevated demand for higher-end, feature-rich products (electric toothbrushes, smart toothbrushes, premium toothpaste lines) rather than the lowest-cost or “mass” everyday items. The shift toward preventive and cosmetic dental products is driving value growth.

Product innovation and premiumisation

Innovation in formulation (e.g., whitening, sensitivity, herbal/natural ingredients), packaging and device integration (smart/connected toothbrushes, digital brushing trackers) creates opportunity for premiumisation and higher margins. For example, smart toothbrushes with pressure sensors, smartphone apps and brushing trackers are gaining traction.

Manufacturers that can combine efficacy, design, devices and brand appeal are well-positioned to capture this premium growth.

E-commerce and distribution channel evolution

Online retail and digital channels are becoming ever‐more important in Europe. Consumers increasingly buy oral care products via online platforms (including D2C brands), enabling greater consumer choice, convenience and loyalty programs. The online channel is showing higher growth relative to traditional channels.

This shift offers opportunity for newer brands, subscription models (e.g., regular toothbrush head replacement), and deeper consumer engagement.

Demographic and lifestyle shifts

An ageing population in many European countries brings increased demand for denture products, specialised hygiene solutions (e.g., for older adults), and functional oral care formats. At the same time, younger consumers driven by aesthetics (teeth-whitening, “Instagram ready” smiles) raise demand for cosmetic oral care. These demographic trends open dual growth lanes.

The rising middle-class, increasing disposable incomes in certain European regions, and greater emphasis on personal grooming also underpin demand.

Sustainability and clean-label trends

Consumers increasingly favour natural/organic formulations, eco-friendly packaging and ethical sourcing—even in oral care. This provides room for innovation and new entrants targeting “clean” or niche oral hygiene segments

Growth in value vs. volume

In many European markets, oral care has reached high penetration; accordingly, volume growth may be modest. Growth is increasingly driven by higher-priced and value-added products rather than purely by unit volume expansion. This dynamic represents an opportunity for brands to focus on differentiation (devices, premium ingredients, subscription models) rather than just competing on price.

3. What Lies Ahead: Emerging Trends Shaping the Future

Looking forward, several key trends are set to shape how the oral care market evolves in Europe:

Smart & connected oral care devices

The adoption of connected toothbrushes, sonic/oscillating models, smartphone-linked brushing trackers, and digital oral care platforms is accelerating. As oral care becomes more integrated with wellness and personal health tracking, devices with sensors, data analytics and app-based engagement will become key differentiators. For example, toothbrushes that monitor brushing habits, pressure and coverage will gain traction.

These devices create ongoing value via consumable replacement (brush heads), subscriptions and ecosystem lock-in.

Personalised and precision oral care

Just as skin care has moved toward personalised formulations, oral care is moving in a similar direction. Customised toothpaste formulations (e.g., for sensitivity, enamel repair, whitening) and toothbrush settings tailored to individual brushing behaviour are gaining ground. Connected devices enable personalised coaching and habit tracking.

Natural, clean-label and sustainable formats

The trend toward “clean beauty” is flowing into oral care. Increasing consumer demand for plant-based, fluoride-free, minimal-ingredient and eco-friendly oral care formats is creating new niches. Brands that deliver both efficacy and transparency (ingredient list, environmental credentials) will capture loyalty.

Emerging & niche segments growth

While major Western European markets remain mature, segments such as electric toothbrushes, whitening accessories, denture care and oral rinses still have growth. Additionally, younger consumers and lifestyle formats (e.g., whitening strips, charcoal toothpaste) are creating fresh demand pockets.

Channel evolution & direct-to-consumer models

D2C brands and online subscriptions are enabling new business models—such as toothbrush head refills on subscription, customised oral care bundles, and device-plus-consumable packages. These allow deeper consumer engagement and higher lifetime value per consumer.

Retail models are also evolving: supermarkets/hypermarkets continue to dominate in sheer volume, but online and specialty channels are growing fastest. The channel mix shift will continue.

Regulatory & ingredient innovation

Stricter regulatory scrutiny (e.g., EU chemical regulations, packaging waste directives) will push brands to innovate in formulation, packaging and waste reduction. At the same time, R&D in active ingredients (e.g., micro-hydroxyapatite, probiotics, enzyme-based cleansers) will support next-generation oral care formats.

Sourcing and production resilience

Global supply-chain disruptions (raw materials, manufacturing) and rising cost pressures will drive manufacturers to localise sourcing, invest in manufacturing efficiency and optimise packaging. Sustainability of supply chains will become part of brand value.

Focus on preventive oral health

As oral care becomes more aligned with general health (cardiovascular, diabetes links, etc.), prevention will become a stronger message. Brands will emphasise gum-health, enamel protection, early-stage intervention and holistic mouth-body link-ages.

4. Segmentation Analysis

Based on the referenced report, the segmentation in the European oral care market is as follows:

By Product

-

Toothbrush

-

Toothpaste

-

Mouthwash/Rinses

-

Denture Products

-

Dental Accessories / Others

By Application / End-Use

-

Home (consumer self-care)

-

Dentistry (professional / clinic use)

By Distribution Channel

-

Supermarkets & Hypermarkets

-

Retail Pharmacies / Drug Stores

-

Online Distribution / E-commerce

By Country / Region (for European national markets)

-

United Kingdom

-

France

-

Germany

-

Italy

-

Spain

-

Sweden

-

Russia

-

Norway

-

Austria

-

Rest of Europe

This segmentation allows players to map product strategy (e.g., premium toothbrush vs mass toothpaste), tailor to application (home vs clinical), select channel strategy (online vs offline) and focus on country-specific markets (where consumer behaviour, regulation and competition differ).

For example, within product categories, the toothpaste segment is expected to register the highest growth in the forecast period 2025-2032, particularly driven by innovations in whitening, anti-sensitivity and functional formulations.

In distribution channels, the online segment held the largest share in 2024 and is expected to grow fastest owing to convenience, wider product range and subscription opportunities. The supermarkets/hypermarkets channel is expected to register fastest growth among the traditional offline formats as multi-category shopping becomes more common.

5. Country-Level Analysis: Germany & UK

Germany

Germany holds the largest share of the European oral care market as of 2024. Key factors include high consumer awareness of oral hygiene, a strong grooming/personal-care culture, advanced product adoption (electric toothbrushes, premium lines), and robust manufacturing/export capabilities for dental products.

German consumers are more willing to spend on premium oral-care products and devices, which supports value growth. The country also leads in dental-product exports, strengthening the broader ecosystem.

Opportunity in Germany lies in higher adoption of premium electric/manual toothbrush hybrids, subscription models for replacement heads, and leverage of “connected oral care” offerings.

United Kingdom (UK)

The UK is another important market. While the UK demonstrates somewhat slower growth compared to emerging Europe, it presents opportunity via digital health adoption, preventive care campaigns and rising aesthetic demand (teeth-whitening, cosmetic) among consumers. The presence of strong retail infrastructure, online penetration and brand loyalty supports growth.

Brands that tailor to UK consumer preferences (e.g., convenience packs, oral-health wellness formats, digital device bundles) can capture further share.

Other countries such as Italy, Spain and France offer latent growth, particularly in value segments and device uptake (electric toothbrushes etc.), while Nordic markets and Eastern Europe may show higher growth rates albeit from a smaller base.

6. Commutator (Strength-Weakness-Opportunity-Threat) Analysis

Strengths

-

High baseline penetration of oral hygiene products and strong cultural consumer awareness in Europe.

-

Innovation-driven segment with premiumisation opportunity (devices, specialised formulations) enabling value growth.

-

Broad product ecosystem (consumer self-care + dental professional products) providing multiple revenue streams.

-

Mature retail and e-commerce infrastructure enabling multi-channel reach.

Weaknesses

-

Modest overall growth rate (~2.8 % CAGR) implies limited volume expansion—competition is intense and differentiation is required to grow value.

-

High penetration and mature consumer markets mean incremental gains require investment in innovation and brand building rather than purely incremental volume.

-

Price sensitivity in some countries, consumer trade-downs and increasing discounting pressure create margin concerns for premium brands.

Opportunities

-

Demand for premium/administered devices (electric toothbrushes, connected devices) and subscription models (brush-head replacement) provide growth beyond classic consumables.

-

Growth in online retail offers new entrant and direct-to-consumer brand models, enabling niche & premium positioning.

-

Clean-label, natural, sustainable oral care is still under-penetrated in Europe and offers differentiation.

-

Emerging segments: denture care, mouthwashes for specific conditions (e.g., gum-health, dryness, older-adult care) and children’s specialised ranges.

-

Regional growth potential: Eastern Europe, Southern Europe, younger demographic segments switching to premium oral-care routines.

Threats

-

Competitive pressure from leading multinational brands and private-label products, which may drive down margins.

-

Economic slowdowns or cost-of-living pressures may lead consumers to “trade down” to lower-cost brands or reduce premium device purchases.

-

Regulatory changes (e.g., chemical restrictions, packaging directives) and raw-material cost volatility could increase cost structures and complexity.

-

Technological disruption: if new devices fail to deliver meaningful value/benefits to consumers, adoption may stall and investment risks rise.

7. Press Release Conclusion

The Europe oral care market stands at a pivotal moment—valued at USD 11.57 billion in 2024, and forecast to grow to USD 14.44 billion by 2032 at a CAGR of ~2.8 %. This growth, though modest in volume, is rich with strategic opportunity for brands, manufacturers and channels that can deliver innovation, differentiation and strong consumer engagement.

While traditional oral-care products (toothpaste, manual toothbrushes) remain core, the future will belong to those who can deliver value via premium devices, connected solutions, personalised formulations, subscription models and sustainability credentials. The shift from “basic hygiene” to “holistic oral wellness” is underway.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness