Mastering Tally ERP: Foundational Skills for Future Accounting Professionals

In today’s digital era, businesses depend on precision-driven accounting systems to maintain financial stability and compliance. Among the many accounting tools available, Tally ERP has earned a reputation as one of the most reliable and user-friendly platforms for managing business finances. It streamlines essential processes like bookkeeping, taxation, payroll, and inventory management, all within a single interface. For aspiring accountants, mastering Tally is not merely about learning software; it’s about understanding the digital transformation shaping modern accounting practices. This blog explores the key skills, techniques, and insights that help accounting professionals excel through Tally mastery. Enhance your accounting skills and gain hands-on experience in digital finance by enrolling in a Tally Course in Chennai, where expert-led training helps you master real-world accounting and business management using Tally ERP.

The Growing Importance of Tally in the Accounting World

Tally plays a vital role in simplifying complex financial operations, helping organizations manage transactions with accuracy and transparency. It serves as a complete business management solution that combines accounting, inventory control, tax management, and payroll into one integrated system. The software minimizes manual effort, reduces human errors, and ensures compliance with taxation laws, all while providing real-time insights into a company’s financial performance. For accounting students and professionals, learning Tally means acquiring the technical expertise needed to operate confidently in digital finance environments.

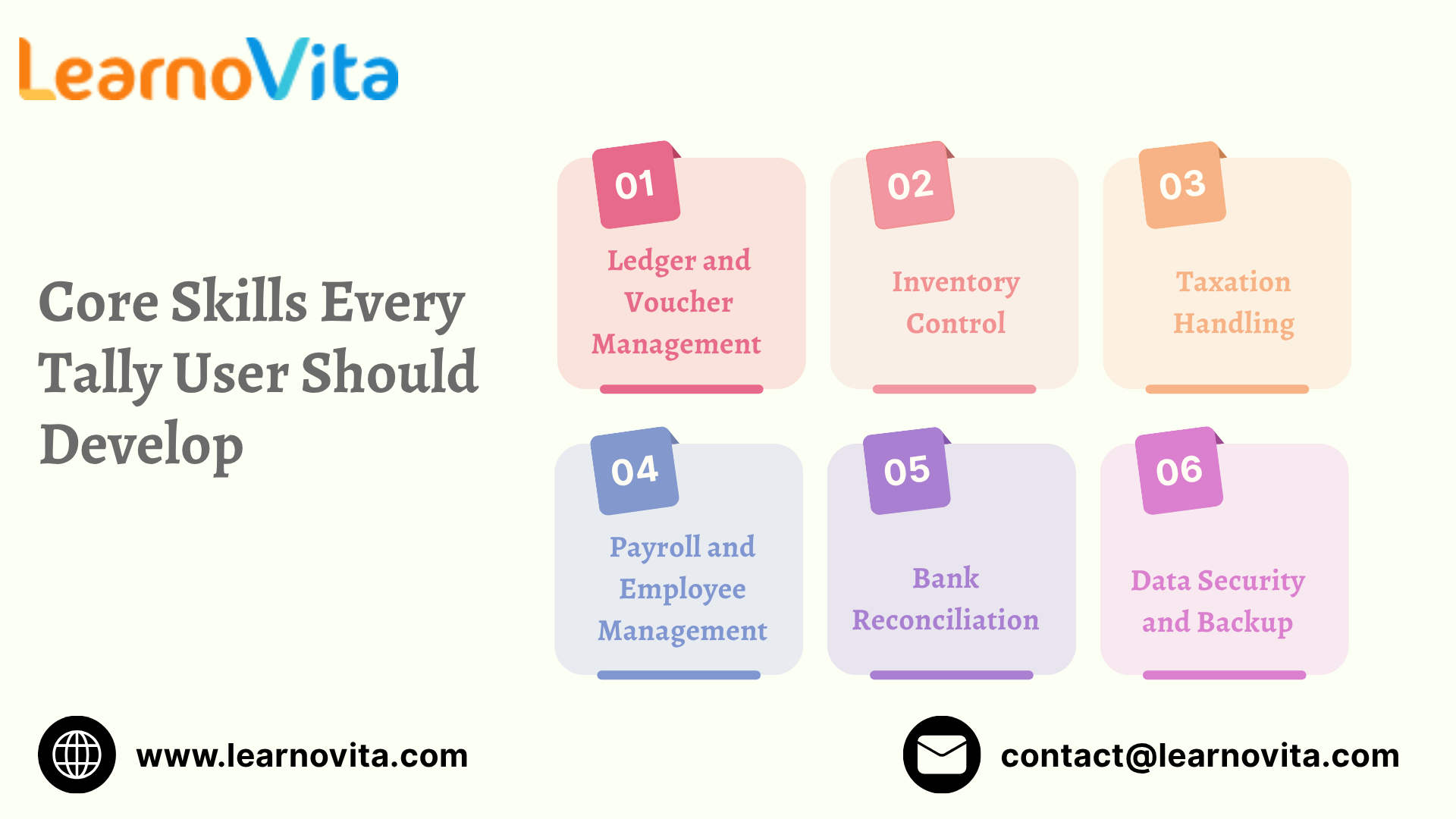

Essential Competencies Every Tally Learner Should Build

To gain complete proficiency in Tally, future accountants should focus on developing a blend of technical and analytical skills that ensure efficiency and precision:

-

Ledger and Voucher Handling – Learn to create, modify, and organize ledgers and vouchers for accurate financial tracking.

-

Inventory Oversight – Understand how to manage stock items, classify them properly, and analyze valuation methods.

-

Tax Compliance Skills – Gain expertise in configuring and managing GST, TDS, and TCS entries for legal accuracy.

-

Payroll and Salary Management – Handle employee records, calculate pay structures, and generate payslips effortlessly.

-

Bank Reconciliation – Match company ledgers with bank statements to ensure balance accuracy.

-

Data Protection and Backup – Learn to secure data through regular backups and proper password management.

Navigating the Tally Interface Effectively

Tally’s interface is designed with simplicity and efficiency in mind, allowing users to manage accounts with minimal effort. The Gateway of Tally serves as the central access point, linking all accounting and inventory modules. Users can perform various functions like transaction entry, report generation, and data configuration without navigating through complex menus. Shortcut keys and intuitive options further enhance user productivity. Once users understand the structure and layout, they can efficiently handle multiple business operations in less time, allowing them to focus more on financial insights and less on system navigation.

Recording and Managing Daily Transactions

One of Tally’s core strengths is its ability to simplify the process of recording daily business transactions. Every financial event, whether it’s sales, purchases, payments, or receipts, is entered through vouchers. This system not only organizes financial records but also ensures they remain audit-friendly and easily traceable. The ability to modify entries, automate recurring vouchers, and use cost centers adds to Tally’s flexibility. With consistent practice, accountants can maintain a clean and transparent record of every business activity, laying the groundwork for accurate financial analysis and compliance. Enroll in a Tally course online to gain hands-on expertise in accounting, GST, inventory management, and financial reporting all from the comfort of your home.

Generating Analytical and Financial Reports

Tally goes beyond data entry, it’s a robust platform for generating actionable financial insights. The software provides real-time reports such as balance sheets, profit and loss accounts, cash flow statements, and stock summaries. These reports offer a holistic view of a company’s financial position and performance. The dynamic nature of Tally ensures that every update in data instantly reflects across reports, maintaining real-time accuracy. However, the true skill lies not just in generating these reports but in interpreting them correctly to guide strategic business decisions and improve financial planning.

Avoiding Common Mistakes in Tally Operations

Even though Tally is user-friendly, many beginners make avoidable mistakes that can affect the integrity of financial records. Here are a few key errors to watch out for:

-

Skipping Regular Backups – Data loss due to system failure can be avoided with routine backups.

-

Incorrect Group Classification – Misplacing ledgers under wrong account groups can distort financial outcomes.

-

Improper Tax Setup – Failing to configure GST or TDS settings properly can lead to compliance issues.

-

Neglecting Bank Reconciliation – Without frequent reconciliation, discrepancies may go unnoticed.

-

Deleting Transactions Unintentionally – Removing vouchers without review can impact reports and balances.

Awareness and regular review practices help maintain accuracy and protect the company’s financial integrity.

Advancing Your Career Through Tally Expertise

Having in-depth knowledge of Tally gives aspiring accountants a distinct professional edge. It opens doors to various roles such as accounts assistant, finance executive, tax consultant, or payroll specialist. Businesses of all scales rely heavily on Tally for financial management, making this skill one of the most in-demand competencies in the accounting world. Enrolling in a Tally Course in Chennai or a certified training program can help students gain hands-on experience and industry-relevant expertise. For professionals seeking long-term growth, Tally proficiency acts as a stepping stone toward advanced roles in finance and business management.

Conclusion

Mastering Tally ERP is not just about learning a software interface, it’s about building a comprehensive understanding of digital accounting principles. From recording accurate transactions to generating insightful reports, Tally equips accountants with the tools needed to ensure precision and efficiency in every financial process. As the accounting world continues to embrace automation and digitalization, those who are skilled in Tally will stand out as capable and future-ready professionals. For anyone aspiring to succeed in the finance industry, developing expertise in Tally ERP is the first step toward a rewarding and sustainable career.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness