Saudi Arabia Coffee Market To Be Driven By Wellness Drinks Industry In The Forecast Period Of 2025-2032

Market Estimation & Definition

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Saudi-Arabia-Coffee-Market/78

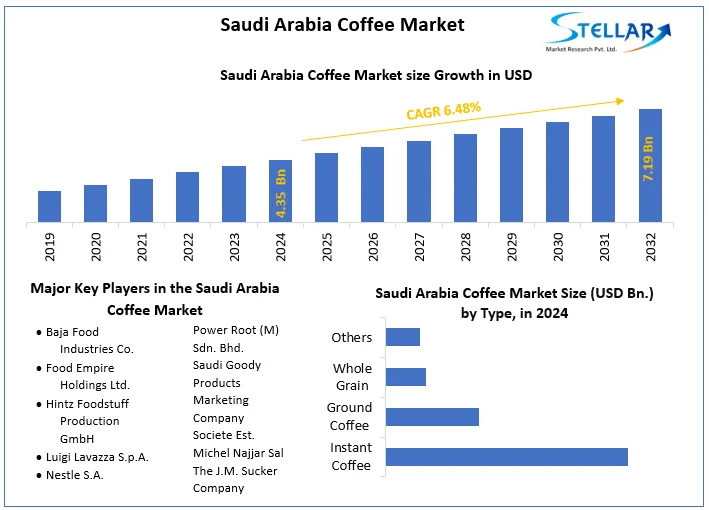

The Saudi Arabia coffee market was valued at approximately USD 4.35 billion in 2024, and is projected to reach around USD 7.19 billion by 2032, representing a compound annual growth rate (CAGR) of about 6.48% between 2025 and 2032.

Coffee in Saudi Arabia encompasses various product formats (instant, ground/whole bean, specialty blends) and distribution channels (supermarkets/hypermarkets, cafés, online retail). As consumers embrace global café culture and premium coffee consumption, the market is evolving from traditional beverage habits toward specialty and experiential formats.

Market Growth Drivers & Opportunities

Several key drivers underpin the growth outlook for the Saudi Arabia coffee market:

-

Expanding café culture and changing consumer lifestyles: Younger consumers and urban populations increasingly favour café visits, specialty coffee blends, flavored coffees and out-of-home consumption. This cultural shift is driving premium coffee demand.

-

Government initiatives and domestic coffee production: Under the country’s Vision 2030 agenda, efforts to diversify the economy include coffee cultivation support and promotion of local coffee — for example, cultivation in the Jazan region and the establishment of the national coffee company.

-

Premiumisation and product innovation: Increased interest in higher-quality beans (Arabica dominates with ~59% share), specialty blends, premium formats and readiness for convenience consumption (capsules, instant, RTD) provide opportunities for differentiation.

-

Rising online & modern retail penetration: E-commerce, mobile ordering, café chains and modern retail formats are expanding, offering coffee brands broader reach and convenience.

From an opportunity standpoint: brands that position themselves in specialty/premium segments, invest in café chains or retail distribution, engage younger consumers, offer branded experiences, and leverage digital and convenience formats will benefit.

What Lies Ahead: Emerging Trends Shaping the Future

Looking ahead to 2025-2032, several trends are set to shape the Saudi Arabia coffee market:

-

Specialty coffee and gourmet experience growth: Consumers are expected to increasingly seek single-origin beans, craft roasting, signature café experiences, cold brew and premium formats—as the standard commoditised coffee matures.

-

Convenience formats and digital ordering: Coffee pods & capsules, RTD coffee beverages, mobile ordering for cafés, subscription models and delivery will grow in importance—especially among urban, time-pressed consumers.

-

Local production and heritage branding: Saudi Arabia’s push to cultivate coffee (especially in Jazan) and promote its own coffee heritage will enhance “local origin” branding and may reduce reliance on imports over time.

-

Sustainability, ethical sourcing and premium credentials: Certifications, sustainable agriculture, transparent sourcing and value-added storytelling will become more relevant in cafés and retail.

-

Growth beyond major cities: While Riyadh, Jeddah and Dammam dominate today, future expansion into satellite cities and smaller towns will broaden the consumption base and bring new growth pockets.

-

Retail channel diversification: Beyond cafés and supermarkets, convenience stores, work-place cafés, drive-through formats and even subscription home-brewing services may expand.

Segmentation Analysis

According to the market data:

-

By Source: The market distinguishes between Arabica and Robusta beans. Arabica holds approximately 59% share in 2024, driven by consumer preference for its sweeter taste and higher lipid content in bean.

-

By Type: Instant Coffee, Ground Coffee, Whole Grain (whole bean) and others. While convenience formats (instant) remain significant, ground/whole bean and specialty formats are gaining share.

-

By Process: Caffeinated vs Decaffeinated. The decaffeinated segment remains niche but is growing as consumer health awareness rises.

-

By Region: The segmentation covers the kingdom broadly (Saudi Arabia); while the report does not necessarily break down further by region in publicly available summary, growth is concentrated in urban centres such as Riyadh, Jeddah and cities with strong café culture.

Country-Level (Saudi Arabia) Specifics

As the market is specific to Saudi Arabia, country-level insight is inherent. Some of the key dynamics:

-

The nation is shifting from a primarily tea-and-Arabic coffee culture to a broader coffee ecosystem (specialty cafés, imported beans, global brands) with younger demographics.

-

The government is promoting domestic coffee cultivation (especially in Jazan region), aiming to increase local production (from ~300 tons to thousands).

-

Café expansion and specialty coffee chains are significant, especially in urban areas. Off-trade retail formats (supermarkets, online) are also growing rapidly.

-

The premium segment’s growth suggests an increasing willingness among Saudi consumers to spend more on “experience” and quality rather than mere commodity coffee.

Competitive Analysis

The Saudi Arabia coffee market features strong competition between global brands and local players. Key players named in the report include:

Baja Food Industries Co., Food Empire Holdings Ltd., Luigi Lavazza S.p.A., Nestlé S.A., Zino Davidoff Group, Yousef Al Rajhi Group among others.

Competitive factors include brand reputation, distribution reach, retail footprint, café presence, product format (instant vs whole bean vs specialty) and consumer experience. New entrants or local specialty roasters may differentiate via local origin, niche brewing techniques, premium beans and café ambience.

Press Release Conclusion

In summary, the Saudi Arabia coffee market is poised for robust growth through 2032, with projected value rising from USD 4.35 billion in 2024 to around USD 7.19 billion by 2032, at a CAGR of approximately 6.48%.

Consumer preference shifts toward premium, specialty coffee, the expansion of café culture, digital and convenience channels, and supportive government initiatives (domestic production, diversification of economy) all underpin the growth. For coffee brands, roasters, café chains and investors aiming to capture Saudi market opportunity, key imperatives include:

-

establishing differentiated premium offerings and branded experiences,

-

tapping into convenience and digital channels (pods, online subscriptions, cafés),

-

leveraging local cultivation and origin storytelling (e.g., Jazan coffee),

-

expanding beyond major metros into emerging urban locations.

For businesses seeking growth in the Middle East beverage sector, Saudi Arabia’s coffee market presents a compelling scenario: a blend of tradition and modernity, rising consumer spend, rapid format evolution and supportive national policy.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness