Microfinance Market Regional Insights

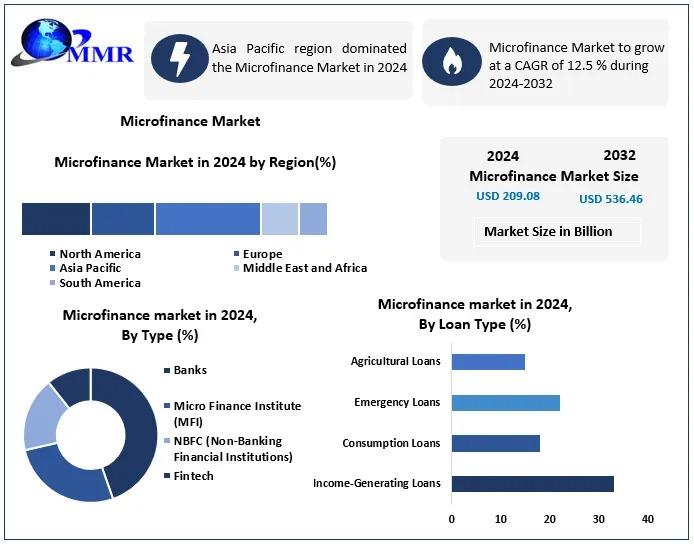

The Microfinance Market spans across six major regions—North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa—each characterized by unique growth drivers and market dynamics. Factors such as technological innovation, regulatory frameworks, trade policies, and shifting consumer preferences play a vital role in shaping the market landscape within these regions.

This report offers a comprehensive regional breakdown, analyzing key elements such as import–export trends, government initiatives, and each region’s contribution to the global market. By understanding these regional distinctions, businesses and investors can gain valuable insights into localized growth patterns, emerging opportunities, and regional challenges. These insights empower organizations to craft targeted strategies that align with local market realities and drive sustainable, long-term growth.

Curious about the market dynamics? Get a free sample to explore the latest insights here:https://www.maximizemarketresearch.com/request-sample/230628/

Market Segmentation

by Type

Banks

Micro Finance Institute (MFI)

NBFC (Non-Banking Financial Institutions)

Fintech

Other

by Loan Type

Income-Generating Loans

Consumption Loans

Emergency Loans

Agricultural Loans

Others

by End User

Individual Borrowers

Micro, Small, and Medium Enterprises (MSMEs)

Women Entrepreneurs

Farmers and Rural Communities

Some of the leading companies in the Microfinance market include:

1. Bandhan Bank

2. Kiva

3. BRAC

4. Bank Rakyat Indonesia

5. BSS Microfinance Private limited

6. FINCA International

7. Grameen Bank

8. Svatantra microfinance

9. Al Amana Microfinance

10. Grameen Foundation

11. Accion International

12. Opportunity International

13. Bharat Financial Inclusion Limited

14. Cashpor Micro Credit

15. Compartamos Banco

Explore More: Visit our website for Additional reports:

Global Hospital Management Software Market https://www.maximizemarketresearch.com/market-report/global-hospital-management-software-market/82312/

Global Data Warehouse as a Service Market https://www.maximizemarketresearch.com/market-report/global-data-warehouse-as-a-service-market/24880/