Cycling Wear Market to be Driven by increasing population in the Forecast Period of 2025-2032

Cycling Wear Market: Performance Apparel Pedals Ahead

1. Market Estimation & Definition

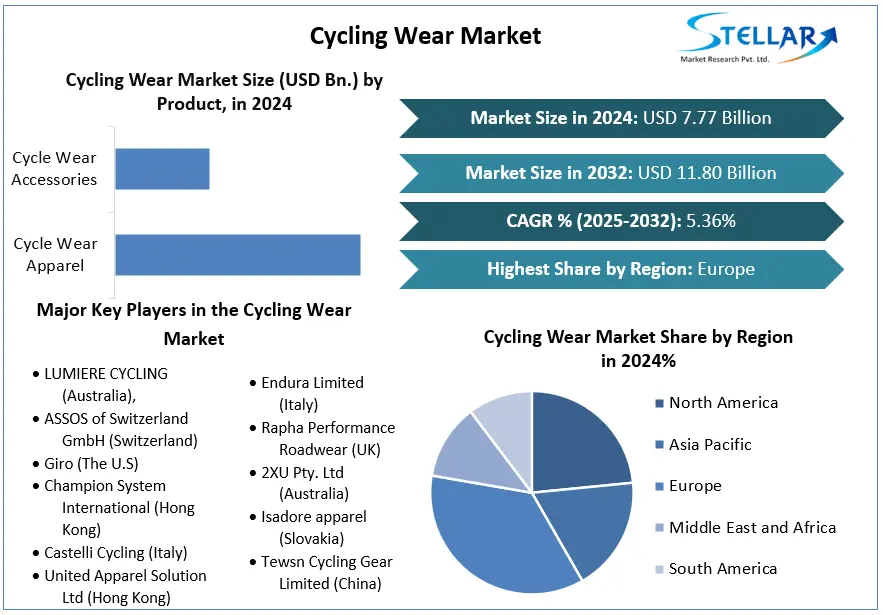

The global cycling wear market was valued at approximately USD 7.77 billion in 2024, and is projected to grow to around USD 11.80 billion by 2032, representing a compound annual growth rate (CAGR) of about 5.36% from 2025 to 2032.

“Cycling wear” here includes apparel and accessories specifically designed for cycling — jerseys, jackets, shorts, leggings, gloves, high‑visibility outerwear, and accessories tailored for comfort, safety, moisture management, performance and commuting.

The market covers performance and leisure cycling segments, commuting/urban biking, sport cycling, and emerging e‑bike user demographics.

With cycling gaining prominence as a health, lifestyle, sustainability and mobility choice, the wearables and apparel segment is rapidly evolving.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Cycling-Wear-Market/272

2. Market Growth Drivers & Opportunity

Several key drivers are boosting the cycling wear market and create clear opportunities:

-

Health & lifestyle shifts: Rising prevalence of sedentary lifestyles, chronic diseases (obesity, diabetes) and an increased emphasis on fitness are encouraging more people to pick up cycling. The report specifically notes that cycling wear demand is supported by growing cycling activity for recreation, commuting and sport.

-

Urban mobility & sustainability trends: With global emphasis on low‑carbon transport, biking—especially in European markets—is promoted. As more people use bicycles for commuting and leisure, demand for functional, comfortable and visible cycling wear increases. Technical innovation in fabrics & safety features: Manufacturers are innovating with moisture‑wicking, windproof, high‑visibility garments, and advanced protective features. For example, jackets with high‑visibility colours and reflective coatings reduce accident risk.

-

Growth in e‑bikes and leisure cycling: As e‑bike use expands (especially in urban and older‑demographic markets), the need for dedicated cycling apparel (commuter‑friendly, adjustable fits, safety features) presents a growth opportunity.

-

Events, cycling culture and sport segments: The increasing number of cycling events (globally) and growing interest in sport cycling create a larger base of cyclists who demand high‑performance wear. The report cites events and tourism cycling as supportive of market growth.

These drivers suggest that growth is both volume‑driven (more cyclists) and value‑driven (higher specification apparel, premium segments). The opportunities lie particularly in urban commuting wear, high‑visibility safety apparel, and leisure/fitness segments.

3. What Lies Ahead: Emerging Trends Shaping the Future

-

High‑visibility and safety oriented apparel: With increased awareness of cyclist safety (especially in Europe), garments with reflective materials, neon colours, crash‑protection features are gaining acceptance and driving upgrade purchases.

-

Sustainability & technical fabrics: Cycling wear brands are integrating recycled fabrics, eco‑friendly dyes, and advanced materials that perform under various weather conditions. These features appeal to environmentally‑aware consumers.

-

E‑commerce growth for niche/gear‑led wear: Online channels are expanding especially for specialised cycling wear, custom fittings, subscription boxes and direct to consumer models.

-

Expansion in Asia‑Pacific & emerging markets: Though Europe dominates today, Asia‑Pacific is expected to report higher growth thanks to increasing urban cycling, infrastructure development and rising fitness consciousness.

-

Commuter to sport crossover apparel: With more urban cyclists seeking sport‑level comfort, and sport cyclists transitioning into urban riding (especially via e‑bike), apparel lines are blurring the boundaries—creating new product categories (dual use: sport + commute).

-

Customization and lifestyle branding: Cycling wear is increasingly a lifestyle statement—brands are offering limited editions, collaborations, fashion‑influenced graphics, and lifestyle features (casual fit, street styling) to broaden appeal beyond “hard core” cycling.

4. Segmentation Analysis

From the report:

By Product Type:

-

Cycle Wear Apparel (dominant segment ~70% share in 2024) – including shorts, jerseys, jackets, leggings etc.

-

Cycle Wear Accessories – including gloves, arm warmers, high‑visibility jackets, headgear etc. Accessories are projected to grow strongly.

By Distribution Channel: -

Hypermarket & Supermarket

-

Specialty Stores

-

E‑Commerce (growing fastest)

-

Others

By Region: -

Europe (dominant region in 2024 with ~34% share)

-

Asia‑Pacific (fastest growing region)

-

North America

-

Middle East & Africa

-

South America

This segmentation highlights where value lies: premium apparel remains the largest part; accessories and specialty gear are growing; the digital channel is gaining share; and Europe remains a mature strong region while Asia‑Pacific offers fastest growth.

5. Country‑Level Analysis

-

United States (North America): A mature market with high disposable incomes, established cycling culture, and strong demand for premium performance wear and brand‑led gear.

-

Germany / Europe: Germany and other European nations are pivotal, benefiting from strong cycling infrastructure, public policy support for biking, and large sport cycling communities. For example, the European leadership in share reflects broad use of bicycles across commuting and recreation.

-

China / Asia‑Pacific: In Asia‑Pacific, countries like China, Japan, India and South Korea are seeing increasing cycling for both fitness and commuting. The report indicates the Asia‑Pacific region is expected to grow at ~6% CAGR.

These country / region insights allow brands and retailers to allocate resources: e.g., premium launches in the US/Europe, high‑volume/commuter gear in Asia, and digital‑first strategies in emerging markets.

6. Commutator (SWOT‑Style) Analysis

Strengths

-

Strong alignment with health, fitness, sustainability and mobility trends—cycling apparel is well‑positioned.

-

Technical innovation (fabrics, safety features, comfort) adds value and justifies premium pricing.

-

Established brand equity among specialist cycling wear manufacturers and loyal consumer base.

Weaknesses

-

High cost of premium cycling wear may limit adoption among casual or commuter cyclists.

-

Supply‑chain and raw‑material pressures (technical fabrics, weather‑proofing) can raise manufacturing cost.

-

Market saturation risk in mature regions (Europe) leading to slower growth.

Opportunities

-

Rising commuter cycling and e‑bike adoption open new segments for cycling‑wear brands beyond traditional sport cyclists.

-

Expansion into accessories and high‑visibility safety wear as cycling infrastructure and regulation increase (especially in urban markets).

-

Growth via online channels, customisation, and lifestyle branding to attract casual cyclists and younger demographics.

Threats

-

E‑bike uptake potentially reduces need for highly technical sport cycling wear (if commuting reduces performance demands).

-

Competition from general activewear and fast‑fashion brands entering cycling apparel niche could pressure specialist brands.

-

Economic downturns may reduce discretionary spend on premium apparel and accessories.

7. Press Release Style Conclusion

The global cycling wear market is pedalling ahead with momentum. Valued at approximately USD 7.77 billion in 2024, and projected to reach around USD 11.80 billion by 2032 (CAGR ~5.36%), the market offers significant growth potential.

For manufacturers, brands and retailers, the strategic path is clear: focus on premium performance apparel, integrate technical fabrics and safety features, expand digital channels, and leverage the commuter/e‑bike trend to broaden market reach. While Europe remains the stronghold today, growth opportunities in Asia‑Pacific and among commuter segments are compelling.

In a world where cycling represents health, sustainability and lifestyle, cycling wear isn’t just functional—it’s emblematic. Brands that deliver stylish, comfortable, high‑performing apparel and gear will ride the wave of change and secure their place in the evolving global cycling culture.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness