Industrial Salt Market to be Driven by increasing population in the Forecast Period of 2025-2032

Industrial Salt Market: Strategic Insights & Future Outlook

Market Estimation & Definition

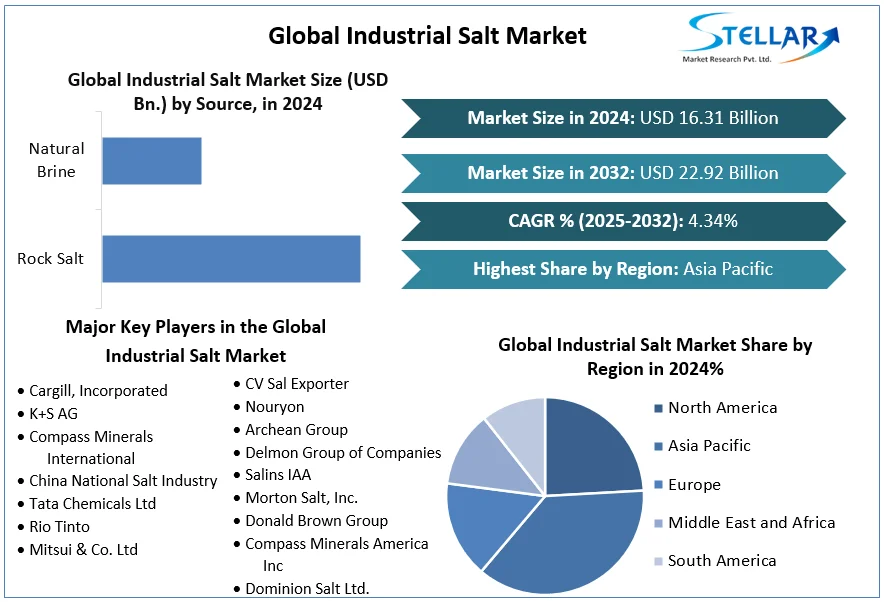

The global Industrial Salt Market is estimated to have been worth USD 16.31 billion in 2024, according to Stellar Market Research, and is projected to grow to USD 22.92 billion by 2032, at a compound annual growth rate (CAGR) of 4.34 % over the 2025–2032 forecast period.

Industrial salt refers to sodium chloride (NaCl) that is not used as table salt, but rather is extracted (from rock salt mines or natural brine) and purified (sometimes with additives) to meet industrial-grade specifications. These salts serve essential roles across multiple sectors, including chemical processing, de-icing, water treatment, oil & gas, glass, polymers, and more.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/industrial-salt-market/2450

Market Growth Drivers & Opportunity

Several compelling drivers are fueling the expansion of the industrial salt market:

-

Chemical Processing Demand: Industrial salt is a key raw material for the chlor-alkali process, which produces chlorine, caustic soda, and hydrogen. These chemicals are foundational for many industries (plastics, pharmaceuticals, cleaning agents, etc.), and as chemical manufacturing expands globally — especially in emerging markets — salt demand correspondingly rises.

-

De-icing Needs: In colder regions, salt is widely used for road de-icing. The report notes that salt used for de-icing accounts for a substantial portion of demand, and seasonal spikes significantly drive consumption.

-

Water Treatment Applications: Salt is critical in water softening — regenerating ion-exchange resins that remove hardness (calcium and magnesium) from water systems. With the rising importance of clean water infrastructure, this application is increasingly significant.

-

Oil & Gas Industry Usage: Industrial salt also finds application in oil & gas operations—for example, in certain drilling and processing stages—further broadening its demand base.

-

Supply Constraints and Strategic Sourcing: Supply chain risks due to natural disasters, geopolitical instability, or transport logistics are creating pressure. These challenges, while constraining supply, also open opportunities for producers to differentiate through reliability, local production, or technological innovation.

Together, these drivers offer strong opportunities for salt producers, chemical firms, and industrial service providers to innovate (e.g., more efficient evaporation, sustainable sourcing) and scale in line with rising demand.

What Lies Ahead: Emerging Trends Shaping the Future

Looking into the future, several trends are likely to reshape the industrial salt market:

-

Sustainable Extraction Methods: There is growing interest in brine-based salt production as an alternative to mining. Natural brine extraction is gaining ground, especially where mining is constrained by environmental regulations. Evaporation Efficiency: The use of solar evaporation, vacuum evaporation, and other more energy-efficient processes is expected to grow, reducing production costs and environmental impact

-

Localized Production for Resilience: To mitigate supply-chain risks, more companies may invest in local or regional salt production capacity, ensuring more reliable supply for critical applications like chemical manufacturing and de-icing.

-

Water Treatment Innovation: Advances in water treatment technologies will continue to boost salt demand. As water utilities modernize and expand, salt-based softening and regeneration solutions remain central.

-

Regulatory & Environmental Pressures: Stricter environmental rules on mining and transport may push producers toward cleaner, low-impact salt production. At the same time, innovators might explore greener additives or more eco-friendly refining processes.

Segmentation Analysis

Stellar’s report segments the market in three core ways:

-

By Source:

-

Rock Salt

-

Natural Brine

-

-

By Manufacturing Process:

-

Conventional Mining

-

Vacuum Evaporation

-

Solar Evaporation

-

-

By Application:

-

Chemical Processing

-

De-icing

-

Water Treatment

-

Oil & Gas

-

Regional / Country-Level Analysis

-

Asia-Pacific: This region dominates the industrial salt market. Rapid industrialization, strong chemical manufacturing, and favorable climatic conditions for salt production contribute to its leadership.

-

China: As a global leader, China produced approximately 53 million tons of salt in 2023.

-

India: India follows with 30 million tons, with large production hubs such as Gujarat.

-

-

Europe: Salt production and export dynamics are strong. Players like Germany are key exporters in the global salt trade.

-

North America (USA): Demand is high for de-icing salt in winter and for industrial uses in chemical and water-treatment sectors, making the U.S. a major consumer in this space.

Competitor (Porter) / Competitive Analysis

Key players in the industrial salt market include Cargill, Incorporated, K+S AG, Rio Tinto, Compass Minerals International, Tata Chemicals Ltd, Israel Chemicals, Morton Salt, and others.

-

Rivalry: Intense — well-established companies compete on scale, cost-efficiency, and global reach.

-

Barriers to Entry: High — capital-intensive operations, regulatory hurdles, and the need for efficient logistics create strong entry barriers.

-

Substitutes: Moderate — while alternatives exist (e.g., calcium chloride for some de-icing applications), NaCl remains fundamental in many industrial processes.

-

Buyer Power: Significant — major chemical companies, utilities, and road agencies can negotiate on price, supply reliability, and quality.

-

Supplier Power: Moderate — producers of high-purity or specialty salt have leverage, but commodity salt is widely available.

Conclusion (Press-Release Style)

The Industrial Salt Market is poised for steady, strategic growth, rising from USD 16.31 billion in 2024 to USD 22.92 billion by 2032, with a projected CAGR of 4.34%. With industrial salt serving as a backbone for vital sectors such as chemical manufacturing, de-icing, water treatment, and oil & gas, its role continues to be indispensable.

Emerging trends—from brine-based extraction and greener evaporation processes to localized production and sustainability-focused innovation—are reshaping how salt is produced and used. Leading salt producers and downstream players who embrace efficiency, environmental responsibility, and resilient supply chains are well positioned to capitalize on long-term demand.

In a world where industrial infrastructure, water systems, and chemical industries keep expanding, industrial salt remains less visible but absolutely essential. The future lies in balancing growth with sustainability, and in leveraging new technologies to keep this humble mineral at the heart of modern industry.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness