How Outsourced Accounting Helps Small Businesses Reduce Errors

Running a small business in 2025 is more challenging and competitive than ever. With rising operational costs, evolving tax regulations, and increased pressure to stay financially compliant, many small business owners struggle to manage their accounting efficiently. Instead of focusing on growth, they often find themselves buried in bookkeeping, payroll, tax filings, and financial reporting. This is why outsourcing accounting for small business has become one of the most strategic decisions entrepreneurs can make in 2025.

Outsourcing allows small businesses to streamline financial operations, reduce costs, and access expert accounting professionals without the need to hire full-time staff. Here’s a deep look into why outsourcing accounting is becoming essential in today’s business environment.

1. Cost Savings and Better Financial Efficiency

Hiring an in-house accountant or finance team can be expensive for small businesses. Beyond salaries, there are costs associated with training, benefits, accounting software, workspace, and retention. These overheads can quickly consume valuable resources.

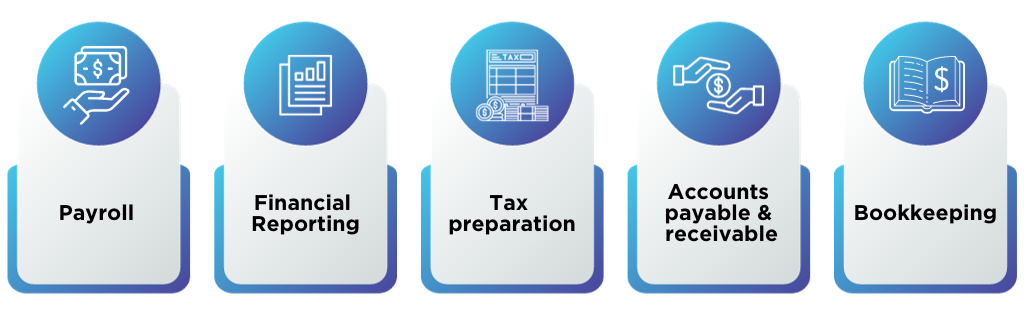

By outsourcing accounting for small business, companies convert fixed staffing costs into flexible service-based expenses. Small businesses pay only for the services they need—whether it’s bookkeeping, payroll, tax prep, or CFO-level guidance. In 2025, as economic conditions fluctuate, this cost-efficient model helps small businesses stay financially stable and avoid unnecessary spending.

2. Access to Highly Skilled Accounting Professionals

Small businesses often cannot afford a team of certified accountants, tax specialists, or financial analysts. Outsourcing gives them access to a pool of experts with diverse skills and experience in:

-

Tax planning and compliance

-

Financial reporting

-

Cash flow management

-

Audit support

-

Industry-specific accounting standards

These experts stay updated with changing laws, technology, and best practices. When it comes to outsourcing accounting for small business, the quality of expertise provided is far superior to what many small businesses can manage internally.

3. Improved Compliance with Changing Regulations

Tax rules, labor laws, and financial reporting standards are constantly evolving. For small business owners wearing multiple hats, keeping up with every regulatory change is difficult.

Outsourced accounting providers ensure compliance by:

-

Monitoring new tax laws and deadlines

-

Following federal, state, and local regulations

-

Ensuring proper documentation and reporting

-

Minimizing risks related to errors or audits

In 2025, with more enforcement around business filings and tax accuracy, outsourcing helps protect small businesses from penalties and non-compliance issues.

4. Enhanced Accuracy and Reduction of Errors

Manual bookkeeping or inexperienced in-house staff can lead to mistakes such as misclassified expenses, reconciliation errors, or incorrect tax filings. These errors can affect financial decisions, cash flow, and long-term stability.

Outsourcing partners use:

-

Standardized workflows

-

Quality control review processes

-

Accounting automation tools

-

Cloud-based systems for accuracy

Through outsourcing accounting for small business, financial tasks are handled by trained professionals who ensure consistency and accuracy at every step.

5. Access to Advanced Technology Without High Costs

Accounting software, automation tools, and advanced reporting systems are expensive for small businesses to purchase and maintain. Outsourcing providers already invest in top-tier accounting technology such as:

-

QuickBooks

-

Xero

-

NetSuite

-

Zoho Books

-

AI-powered bookkeeping tools

-

Automated reconciliation systems

These tools enhance accuracy, speed, and transparency. Small businesses benefit from world-class accounting infrastructure without making heavy software investments.

6. Better Cash Flow Management

In 2025, cash flow remains one of the biggest challenges for small businesses. Poor cash flow can lead to delayed payments, lack of inventory, operational disruptions, or even business closure.

Outsourced accounting teams help small businesses:

-

Track receivables and payables

-

Identify cash flow gaps

-

Forecast future cash needs

-

Manage budgets effectively

-

Prevent overspending

With professional oversight, small businesses gain reliable financial insights that help them stay sustainable and profitable.

7. More Time to Focus on Core Business Activities

Small business owners juggle tasks like marketing, customer service, operations, and sales. Accounting work only adds to the pressure. Outsourcing eliminates hours spent on bookkeeping, reconciliations, payroll, and tax preparation.

When outsourcing accounting for small business, owners free up valuable time and energy to focus on:

-

Growing the business

-

Improving products or services

-

Building customer relationships

-

Expanding into new markets

Outsourcing improves productivity and allows entrepreneurs to concentrate on the work that matters most.

8. Scalability for Growing Small Businesses

As businesses grow, their accounting needs become more complex. What worked during the startup phase may no longer be sufficient. Outsourcing provides scalable solutions that adjust to the company’s growth.

Whether a business needs seasonal support, expanded bookkeeping, CFO advisory, or advanced financial analysis, outsourcing partners can scale services up or down instantly. This flexibility makes outsourcing accounting for small business a long-term and future-proof strategy.

9. Strengthened Data Security

Accounting data is sensitive and must be protected from breaches, internal fraud, or accidental loss. Reputable outsourcing providers use:

-

Encrypted systems

-

Secure cloud platforms

-

Multi-factor authentication

-

Restricted access controls

-

Regular data backups

These security measures ensure that financial data remains protected at all times—often safer than traditional in-house storage methods.

10. Strategic Financial Insights With Expert Guidance

Many outsourcing firms offer virtual CFO or financial advisory services. These experts provide insights that help small businesses:

-

Make informed decisions

-

Plan budgets

-

Reduce unnecessary expenses

-

Identify new revenue opportunities

-

Improve long-term financial performance

In 2025, data-driven decision-making is crucial. Outsourcing helps small businesses access strategic financial leadership without the high cost of hiring a full-time CFO.

Conclusion

The business landscape in 2025 demands efficiency, accuracy, and financial discipline. Outsourcing accounting for small business has become a strategic solution that offers expert support, advanced technology, cost savings, and improved compliance. By outsourcing accounting tasks, small businesses can focus on their strengths, scale sustainably, and stay competitive in a challenging market.

For small business owners seeking long-term growth, outsourcing is no longer optional—it’s a smart, future-ready decision.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness