Asia-Pacific Bio Butanol Market to be Driven by increasing population in the Forecast Period of 2025-2032

Asia-Pacific Bio-Butanol Market: Growth, Opportunities & Emerging Trends

market Estimation & Definition

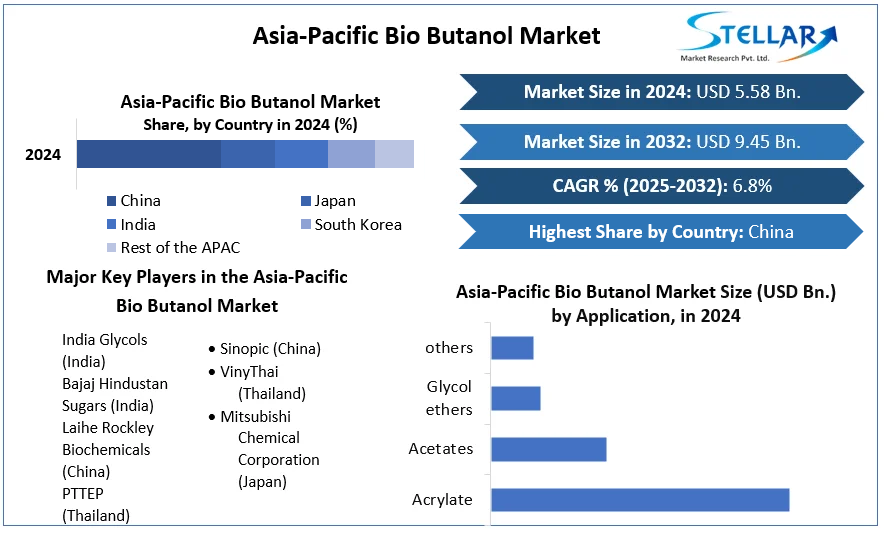

In the Asia-Pacific region, the bio-butanol market was estimated at USD 5.58 billion in 2024, with a projection to reach approximately USD 9.45 billion by 2032, implying a compound annual growth rate (CAGR) of about 6.8% over the period 2025-2032.

Bio-butanol is a renewable bio-based alcohol derived from biomass feedstocks (such as cereals, sugar-cane, sugar-beet, wood, corn) and is used both as a fuel/additive and as a chemical intermediate (for acrylates, acetates, glycol ethers, solvents). In the Asia-Pacific context, it serves industries such as transportation, construction, power generation and medicals.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Asia-Pacific-Bio-Butanol-Market/1212

Market Growth Drivers & Opportunity

Several key drivers are promoting expansion of the Asia-Pacific bio-butanol market:

-

Sustainability push and bio-based chemical demand: With increasing regulatory and corporate commitments to reduce greenhouse gas emissions, bio-butanol is gaining traction as a more environmentally friendly alternative to petroleum-derived butanol. Renewable feedstocks, lower carbon impact and greener credentials are driving uptake.

-

Large downstream chemical industry in Asia-Pacific: The region – especially China, India, Japan and Southeast Asia – has a strong presence in paints & coatings, plastics, adhesives, solvents and chemical manufacturing. Bio-butanol plays a critical role as a feedstock for butyl acrylates and other derivatives, thus demand from these sectors is supportive.

-

Fuel additive potential and transportation sector demand: Some applications of bio-butanol include use as drop-in biofuel or additive in transportation, particularly in markets seeking alternative fuels. Though more mature in other regions, Asia-Pacific’s growing automotive base and interest in cleaner mobility support incremental demand.

-

Feedstock availability and agricultural base: Countries in Asia-Pacific have strong agricultural production (corn, sugarcane, cereals, biomass) which provide the raw material base for bio-butanol production. This contributes to localized production and supply-chain advantages.

-

Growing infrastructure and construction activity: With major infrastructure programmes underway in India, China and ASEAN, demand for paints, coatings, construction chemicals and adhesives increases – which in turn supports feedstocks like bio-butanol-derived acrylates and glycol ethers.

These drivers highlight notable opportunities for manufacturers of bio-butanol, processors of biomass feedstock, chemical intermediates players and regional industrial consumers.

What Lies Ahead: Emerging Trends Shaping the Future

Looking forward, the Asia-Pacific bio-butanol market is expected to evolve under several important trends:

-

Premiumisation of bio-based chemical feedstocks: As downstream users (coatings, adhesives, plastics) seek more sustainable raw materials, bio-butanol’s value proposition rises—leading to premium pricing and differentiated grades.

-

Integration of bio-butanol into fuel ecosystems: While chemical feedstock remains dominant, increasing regulatory pressure on fossil fuels may drive stronger adoption of bio-butanol as part of biofuel blends in Asia-Pacific.

-

Technology innovation in production processes: Advances in fermentation, feedstock pretreatment (e.g., from wood or sugar-beet), and process intensification will reduce costs and improve yields, making bio-butanol more competitive.

-

Expansion of regional manufacturing capacity: Countries such as India, Thailand, Indonesia, China and Australia may see increased investment in bio-butanol plants to serve local and export markets, reducing reliance on imports.

-

Composite use cases & circular chemistry: Linking bio-butanol production with agricultural waste, biorefineries and circular-economy models will help reduce costs, improve sustainability metrics and capture value across feedstock to end-use.

These trends suggest the market will shift from simply volume growth to value-enhanced chemistry and regional integration.

Segmentation Analysis

The Asia-Pacific bio-butanol market is segmented by several dimensions:

-

By Raw Material: cereals; sugar-cane; sugar-beet; wood; corn.

-

By Application: acrylate; acetates; glycol ethers; others.

By Country / Region: China; India; Japan; South Korea; Australia; ASEAN; Rest of APAC.

-

In practice:

-

The raw-material segment of sugar-cane and cereals may dominate due to regional feedstock availability.

-

Application segments such as acrylates (for coatings/adhesives) are likely to hold highest share given demand in chemicals.

-

Among end-users, the construction and chemical industries are significant due to the link between bio-butanol and paints/adhesives.

Country-Level Analysis

-

China: As the largest chemical manufacturing base in APAC and a major consumer of coatings, adhesives and plastics, China represents a key market for bio-butanol. Its government’s bio-economy and renewable policies further support uptake.

-

India: With ambitious infrastructure programmes, growing automotive manufacturing, and an agricultural raw-material base (sugar-cane, cereals), India is a high-growth market for bio-butanol.

-

Japan / South Korea / Australia: These more mature markets are likely to demand higher-specification bio-butanol (for specialty chemicals, biofuels) and offer opportunities for premium supply.

-

ASEAN (Southeast Asia): Countries such as Thailand, Malaysia and Indonesia, with biomass availability and expanding chemical sectors, are emerging as both feedstock supply and chemical consumption hubs.

Competitive / Industry Landscape

The market features a mix of established chemical companies and emerging specialist bio-fuel/biochemical firms in the region. Key strategic factors include access to biomass feedstocks, production technology, partnerships with downstream chemical users, and ability to meet regulatory/ sustainability credentials.

From a strategic analysis:

-

Competitive Rivalry: Moderate-High — multiple players competing to supply feedstocks, intermediates and renewable chemicals.

-

Barriers to Entry: Moderate — scale, technology and feedstock access are meaningful but not insurmountable.

-

Threat of Substitutes: Moderate — petroleum-based butanol remains the incumbent, but regulatory/ sustainability trends reduce substitution risk.

-

Buyer Power: Strong among large chemical and coatings companies demanding quality, certification and cost competitiveness.

-

Supplier Power: Moderate — feedstock suppliers (biomass, cereals, sugar-cane) may exert influence but competition among supply sources exists.

Press-Release Style Conclusion

The Asia-Pacific bio-butanol market is poised for meaningful growth—from a base of USD 5.58 billion in 2024 to approximately USD 9.45 billion by 2032, at a projected CAGR of around 6.8%. It is driven by rising demand for sustainable chemicals, strong downstream industries in Asia-Pacific (coatings, adhesives, plastics), growing bio-fuel interest, and abundant regional feedstocks.

For chemical manufacturers, biorefineries, bio-fuel producers, and downstream users, the strategic imperative is clear: invest in feedstock-to-chemistry integration, develop regional manufacturing capacity, differentiate through performance and sustainability credentials, and partner with end-users to capture value. As the region pursues decarbonisation and circular-economy models, bio-butanol is well-positioned to become a cornerstone of sustainable chemical supply chains.

In short: Asia-Pacific is not just a growth region for bio-butanol—it is set to become a strategic hub where feedstock, chemistry and industrial demand converge. Companies that align with this transition early will be best placed to flourish in the emerging bio-based economy.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness