Maritime Freight Transport Market Trends, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Maritime Freight Transport Market Sails Ahead: Global Trade & Logistics Drive Growth

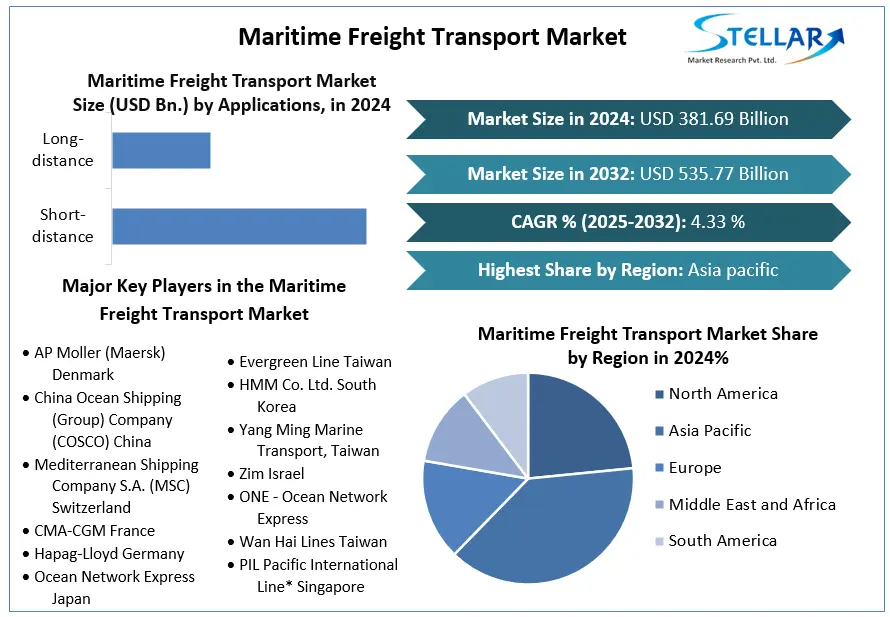

Market Estimation & Definition

Maritime freight transport refers to the movement of goods via sea routes using cargo ships, container vessels, tankers, bulk carriers, and specialized shipping vessels. It is a critical component of global trade, responsible for transporting raw materials, finished goods, and commodities across continents. The market encompasses vessel operations, port services, logistics management, and shipping support services, forming the backbone of international supply chains.

The global maritime freight transport market continues to expand due to growing international trade, globalization, and the demand for cost-effective bulk transport solutions. Sea freight remains the most economical method for shipping large volumes of goods over long distances, offering efficiency and reliability compared to air transport.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Maritime-Freight-Transport-Market/1992

Market Growth Drivers & Opportunities

1. Increasing Global Trade & E-Commerce

The surge in global trade, fueled by rising consumer demand and industrial production, is a primary driver. Cross-border e-commerce has also accelerated, requiring efficient maritime logistics to transport goods to distribution centers and retail hubs worldwide.

2. Cost-Effective Bulk Shipping

Maritime freight is the most cost-efficient mode of transporting large quantities of goods, especially bulk commodities such as crude oil, coal, grains, and metals. Its cost advantage over air or rail transport sustains high demand from industrial sectors.

3. Growth in Emerging Economies

Rapid industrialization and urbanization in emerging economies, especially in Asia-Pacific, Africa, and Latin America, are driving the need for import and export services, strengthening the maritime freight market.

4. Technological Advancements & Automation

Port automation, GPS tracking, blockchain-based logistics solutions, and digital freight platforms have increased operational efficiency, transparency, and reliability, attracting more shippers to maritime transport.

5. Expansion of Shipping Routes & Infrastructure

Development of new shipping lanes, container terminals, deep-water ports, and canal expansions (e.g., Panama and Suez) facilitates faster, safer, and higher-capacity cargo movement, enhancing market growth opportunities.

What Lies Ahead: Emerging Trends Shaping the Future

Green Shipping & Sustainable Practices

Environmental regulations and pressure to reduce carbon emissions are pushing shipping companies to adopt eco-friendly fuel, energy-efficient vessels, and alternative propulsion systems. Sustainability is expected to be a key differentiator for maritime freight operators.

Smart Shipping & IoT Integration

IoT sensors, smart containers, automated navigation systems, and real-time monitoring enable improved operational efficiency, cargo tracking, and predictive maintenance.

Digital Freight Platforms & Blockchain Adoption

Digital logistics platforms and blockchain are improving transparency, reducing fraud, streamlining payments, and optimizing shipment planning across global supply chains.

Growth of Containerized Shipping

The rise of containerization allows faster loading, unloading, and handling of goods, supporting just-in-time supply chains and reducing logistics costs for manufacturers and retailers.

Resilience in Supply Chain & Risk Management

In response to disruptions such as natural disasters, geopolitical tensions, and pandemics, maritime freight operators are investing in diversified routes, safety measures, and flexible scheduling systems.

Segmentation Analysis

Based on typical segmentation in maritime freight market reports:

By Cargo Type

Dry Bulk Cargo (coal, grains, minerals)

Liquid Bulk Cargo (oil, chemicals, LNG)

Containerized Cargo (retail goods, electronics, machinery)

Roll-on/Roll-off (vehicles, heavy machinery)

By Service Type

Freight Shipping / Ocean Freight

Port & Terminal Services

Logistics & Supply Chain Management

By Vessel Type

Container Ships

Bulk Carriers

Tankers (Oil, Chemical, LNG)

Ro-Ro Ships

Specialized Cargo Vessels

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Maritime Freight Transport Market Sails Ahead: Global Trade & Logistics Drive Growth

Market Estimation & Definition

Maritime freight transport refers to the movement of goods via sea routes using cargo ships, container vessels, tankers, bulk carriers, and specialized shipping vessels. It is a critical component of global trade, responsible for transporting raw materials, finished goods, and commodities across continents. The market encompasses vessel operations, port services, logistics management, and shipping support services, forming the backbone of international supply chains.

The global maritime freight transport market continues to expand due to growing international trade, globalization, and the demand for cost-effective bulk transport solutions. Sea freight remains the most economical method for shipping large volumes of goods over long distances, offering efficiency and reliability compared to air transport.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Maritime-Freight-Transport-Market/1992

Market Growth Drivers & Opportunities

1. Increasing Global Trade & E-Commerce

The surge in global trade, fueled by rising consumer demand and industrial production, is a primary driver. Cross-border e-commerce has also accelerated, requiring efficient maritime logistics to transport goods to distribution centers and retail hubs worldwide.

2. Cost-Effective Bulk Shipping

Maritime freight is the most cost-efficient mode of transporting large quantities of goods, especially bulk commodities such as crude oil, coal, grains, and metals. Its cost advantage over air or rail transport sustains high demand from industrial sectors.

3. Growth in Emerging Economies

Rapid industrialization and urbanization in emerging economies, especially in Asia-Pacific, Africa, and Latin America, are driving the need for import and export services, strengthening the maritime freight market.

4. Technological Advancements & Automation

Port automation, GPS tracking, blockchain-based logistics solutions, and digital freight platforms have increased operational efficiency, transparency, and reliability, attracting more shippers to maritime transport.

5. Expansion of Shipping Routes & Infrastructure

Development of new shipping lanes, container terminals, deep-water ports, and canal expansions (e.g., Panama and Suez) facilitates faster, safer, and higher-capacity cargo movement, enhancing market growth opportunities.

What Lies Ahead: Emerging Trends Shaping the Future

Green Shipping & Sustainable Practices

Environmental regulations and pressure to reduce carbon emissions are pushing shipping companies to adopt eco-friendly fuel, energy-efficient vessels, and alternative propulsion systems. Sustainability is expected to be a key differentiator for maritime freight operators.

Smart Shipping & IoT Integration

IoT sensors, smart containers, automated navigation systems, and real-time monitoring enable improved operational efficiency, cargo tracking, and predictive maintenance.

Digital Freight Platforms & Blockchain Adoption

Digital logistics platforms and blockchain are improving transparency, reducing fraud, streamlining payments, and optimizing shipment planning across global supply chains.

Growth of Containerized Shipping

The rise of containerization allows faster loading, unloading, and handling of goods, supporting just-in-time supply chains and reducing logistics costs for manufacturers and retailers.

Resilience in Supply Chain & Risk Management

In response to disruptions such as natural disasters, geopolitical tensions, and pandemics, maritime freight operators are investing in diversified routes, safety measures, and flexible scheduling systems.

Segmentation Analysis

Based on typical segmentation in maritime freight market reports:

By Cargo Type

Dry Bulk Cargo (coal, grains, minerals)

Liquid Bulk Cargo (oil, chemicals, LNG)

Containerized Cargo (retail goods, electronics, machinery)

Roll-on/Roll-off (vehicles, heavy machinery)

By Service Type

Freight Shipping / Ocean Freight

Port & Terminal Services

Logistics & Supply Chain Management

By Vessel Type

Container Ships

Bulk Carriers

Tankers (Oil, Chemical, LNG)

Ro-Ro Ships

Specialized Cargo Vessels

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Maritime Freight Transport Market Trends, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Maritime Freight Transport Market Sails Ahead: Global Trade & Logistics Drive Growth

Market Estimation & Definition

Maritime freight transport refers to the movement of goods via sea routes using cargo ships, container vessels, tankers, bulk carriers, and specialized shipping vessels. It is a critical component of global trade, responsible for transporting raw materials, finished goods, and commodities across continents. The market encompasses vessel operations, port services, logistics management, and shipping support services, forming the backbone of international supply chains.

The global maritime freight transport market continues to expand due to growing international trade, globalization, and the demand for cost-effective bulk transport solutions. Sea freight remains the most economical method for shipping large volumes of goods over long distances, offering efficiency and reliability compared to air transport.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Maritime-Freight-Transport-Market/1992

Market Growth Drivers & Opportunities

1. Increasing Global Trade & E-Commerce

The surge in global trade, fueled by rising consumer demand and industrial production, is a primary driver. Cross-border e-commerce has also accelerated, requiring efficient maritime logistics to transport goods to distribution centers and retail hubs worldwide.

2. Cost-Effective Bulk Shipping

Maritime freight is the most cost-efficient mode of transporting large quantities of goods, especially bulk commodities such as crude oil, coal, grains, and metals. Its cost advantage over air or rail transport sustains high demand from industrial sectors.

3. Growth in Emerging Economies

Rapid industrialization and urbanization in emerging economies, especially in Asia-Pacific, Africa, and Latin America, are driving the need for import and export services, strengthening the maritime freight market.

4. Technological Advancements & Automation

Port automation, GPS tracking, blockchain-based logistics solutions, and digital freight platforms have increased operational efficiency, transparency, and reliability, attracting more shippers to maritime transport.

5. Expansion of Shipping Routes & Infrastructure

Development of new shipping lanes, container terminals, deep-water ports, and canal expansions (e.g., Panama and Suez) facilitates faster, safer, and higher-capacity cargo movement, enhancing market growth opportunities.

What Lies Ahead: Emerging Trends Shaping the Future

Green Shipping & Sustainable Practices

Environmental regulations and pressure to reduce carbon emissions are pushing shipping companies to adopt eco-friendly fuel, energy-efficient vessels, and alternative propulsion systems. Sustainability is expected to be a key differentiator for maritime freight operators.

Smart Shipping & IoT Integration

IoT sensors, smart containers, automated navigation systems, and real-time monitoring enable improved operational efficiency, cargo tracking, and predictive maintenance.

Digital Freight Platforms & Blockchain Adoption

Digital logistics platforms and blockchain are improving transparency, reducing fraud, streamlining payments, and optimizing shipment planning across global supply chains.

Growth of Containerized Shipping

The rise of containerization allows faster loading, unloading, and handling of goods, supporting just-in-time supply chains and reducing logistics costs for manufacturers and retailers.

Resilience in Supply Chain & Risk Management

In response to disruptions such as natural disasters, geopolitical tensions, and pandemics, maritime freight operators are investing in diversified routes, safety measures, and flexible scheduling systems.

Segmentation Analysis

Based on typical segmentation in maritime freight market reports:

By Cargo Type

Dry Bulk Cargo (coal, grains, minerals)

Liquid Bulk Cargo (oil, chemicals, LNG)

Containerized Cargo (retail goods, electronics, machinery)

Roll-on/Roll-off (vehicles, heavy machinery)

By Service Type

Freight Shipping / Ocean Freight

Port & Terminal Services

Logistics & Supply Chain Management

By Vessel Type

Container Ships

Bulk Carriers

Tankers (Oil, Chemical, LNG)

Ro-Ro Ships

Specialized Cargo Vessels

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Comentários

0 Compartilhamentos

761 Visualizações

0 Anterior