Hydraulic Fracturing Market Size To Grow At A CAGR Of 6% In The Forecast Period Of 2025-2032

Hydraulic Fracturing Market: Strategic Outlook & Future Trajectory

Market Estimation & Definition

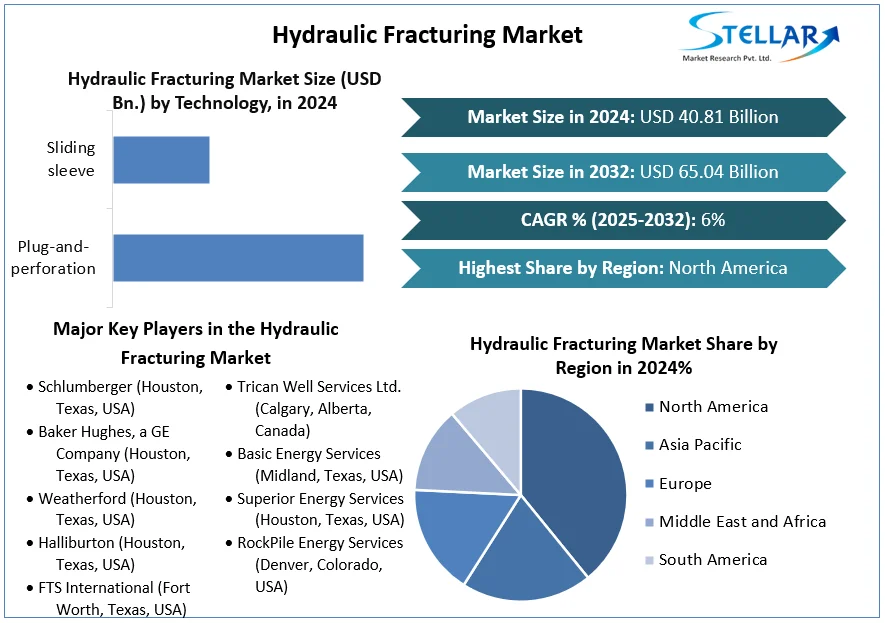

According to Stellar Market Research, the global Hydraulic Fracturing (fracking) Market was valued at USD 40.81 billion in 2024, and is projected to grow to USD 65.04 billion by 2032, at a compound annual growth rate (CAGR) of 6.0 % over 2025–2032.

Hydraulic fracturing is the process of injecting a high-pressure fluid — usually a mixture of water, chemicals, and proppant (like sand) — into oil- or gas-bearing rock to create fractures. These fissures enhance permeability, allowing hydrocarbons to flow more freely and improving production, especially from tight or unconventional reservoirs.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/hydraulic-fracturing-market/2449

Market Growth Drivers & Opportunity

Several powerful forces are fueling the expansion of the hydraulic fracturing market:

Rising Global Energy Demand: With industrialization and population growth, demand for energy continues to escalate. Traditional oil and gas reserves are under pressure, pushing companies to invest in unconventional resources accessible via fracking.

High Oil and Gas Prices: Volatility and spikes in crude oil and natural gas prices make fracking economically attractive, encouraging more drilling and completion activities.

Onshore & Offshore Exploration: As conventional onshore reserves dwindle, exploration is shifting toward offshore and deepwater fields, many of which require advanced fracturing techniques.

Unconventional Resource Development: The growth of shale gas, tight oil, and other tight formations is driving continued adoption of hydraulic fracturing to unlock these hard-to-reach reserves.

Strategic Consolidations & Technological Investments: Companies in the fracking space are actively merging, acquiring, and investing in next-gen fleets, eco-fleets, and more efficient fracturing services.

These drivers create major opportunities for service providers, equipment manufacturers, technology innovators, and upstream oil & gas firms to collaborate and scale.

What Lies Ahead: Emerging Trends Shaping the Future

Key trends set to define the future of the fracking market include:

Electric & “Green” Fracturing Fleets: There is a growing shift to electric-powered fracturing fleets to reduce emissions and operational costs, especially in response to environmental pressures.

Real-Time Analytics & Automation: Big-data platforms, real-time monitoring, and predictive analytics are being adopted to optimize fluid volumes, pumping rates, and operational efficiency.

Press-Release Style Conclusion

As the global hydraulic fracturing market accelerates from USD 40.81 billion in 2024 to a forecasted USD 65.04 billion by 2032, the sector stands at a pivotal juncture. Fueled by surging energy demand, rising oil price dynamics, and a shift to unconventional reservoirs, hydraulic fracturing continues to be a cornerstone for modern oil and gas production. At the same time, environmental challenges—especially water consumption, methane emissions, and public resistance—are pushing the industry toward greener, more efficient practices.

Leading service providers, drilling companies, and technology innovators must navigate this evolving landscape by embracing electric fracturing fleets, real-time analytics, and water-conservation technologies. Firms that succeed in integrating operational excellence with environmental stewardship will be best positioned to lead the next wave of growth.

In short, the hydraulic fracturing market's future hinges not just on unlocking new resources, but on doing so responsibly — with innovation, sustainability, and scale.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]Hydraulic Fracturing Market Size To Grow At A CAGR Of 6% In The Forecast Period Of 2025-2032

Hydraulic Fracturing Market: Strategic Outlook & Future Trajectory

Market Estimation & Definition

According to Stellar Market Research, the global Hydraulic Fracturing (fracking) Market was valued at USD 40.81 billion in 2024, and is projected to grow to USD 65.04 billion by 2032, at a compound annual growth rate (CAGR) of 6.0 % over 2025–2032.

Hydraulic fracturing is the process of injecting a high-pressure fluid — usually a mixture of water, chemicals, and proppant (like sand) — into oil- or gas-bearing rock to create fractures. These fissures enhance permeability, allowing hydrocarbons to flow more freely and improving production, especially from tight or unconventional reservoirs.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/hydraulic-fracturing-market/2449

Market Growth Drivers & Opportunity

Several powerful forces are fueling the expansion of the hydraulic fracturing market:

Rising Global Energy Demand: With industrialization and population growth, demand for energy continues to escalate. Traditional oil and gas reserves are under pressure, pushing companies to invest in unconventional resources accessible via fracking.

High Oil and Gas Prices: Volatility and spikes in crude oil and natural gas prices make fracking economically attractive, encouraging more drilling and completion activities.

Onshore & Offshore Exploration: As conventional onshore reserves dwindle, exploration is shifting toward offshore and deepwater fields, many of which require advanced fracturing techniques.

Unconventional Resource Development: The growth of shale gas, tight oil, and other tight formations is driving continued adoption of hydraulic fracturing to unlock these hard-to-reach reserves.

Strategic Consolidations & Technological Investments: Companies in the fracking space are actively merging, acquiring, and investing in next-gen fleets, eco-fleets, and more efficient fracturing services.

These drivers create major opportunities for service providers, equipment manufacturers, technology innovators, and upstream oil & gas firms to collaborate and scale.

What Lies Ahead: Emerging Trends Shaping the Future

Key trends set to define the future of the fracking market include:

Electric & “Green” Fracturing Fleets: There is a growing shift to electric-powered fracturing fleets to reduce emissions and operational costs, especially in response to environmental pressures.

Real-Time Analytics & Automation: Big-data platforms, real-time monitoring, and predictive analytics are being adopted to optimize fluid volumes, pumping rates, and operational efficiency.

Press-Release Style Conclusion

As the global hydraulic fracturing market accelerates from USD 40.81 billion in 2024 to a forecasted USD 65.04 billion by 2032, the sector stands at a pivotal juncture. Fueled by surging energy demand, rising oil price dynamics, and a shift to unconventional reservoirs, hydraulic fracturing continues to be a cornerstone for modern oil and gas production. At the same time, environmental challenges—especially water consumption, methane emissions, and public resistance—are pushing the industry toward greener, more efficient practices.

Leading service providers, drilling companies, and technology innovators must navigate this evolving landscape by embracing electric fracturing fleets, real-time analytics, and water-conservation technologies. Firms that succeed in integrating operational excellence with environmental stewardship will be best positioned to lead the next wave of growth.

In short, the hydraulic fracturing market's future hinges not just on unlocking new resources, but on doing so responsibly — with innovation, sustainability, and scale.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]