Depilatory Product Market Size to Grow at a CAGR of 6.6% in the Forecast Period of 2025-2032

Depilatory Product Market

Market Estimation & Definition

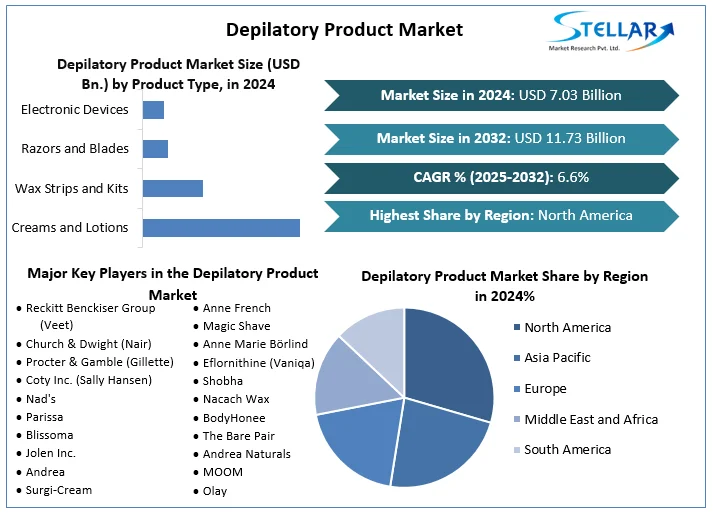

The Depilatory Product Market includes a variety of hair-removal solutions—such as depilatory creams, wax-based kits, blades/razors, and electronic hair-removal devices—designed to temporarily remove unwanted hair. According to Stellar Market Research, the global depilatory product market was valued at approximately USD 7.03 billion in 2024 and is anticipated to grow to USD 11.73 billion by 2032, registering a compound annual growth rate (CAGR) of around 6.6% from 2025 to 2032.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Depilatory-Product-Market/1478

Market Growth Drivers & Opportunity

Several key factors are driving this strong market expansion:

Increasing Grooming & Beauty Awareness: Evolving beauty standards and personal grooming routines are fueling demand for effective and convenient hair-removal solutions.

Convenience of At-Home Use: Depilatory creams, wax kits, and electronic devices allow consumers to remove hair without visiting salons, providing both time savings and cost efficiency.

Innovative Product Formulations: Advances in depilatory chemistry—such as gentle, unscented, and natural-ingredient formulas—are addressing sensitivity concerns and expanding appeal to a wider user base.

Growth in Male Grooming: As male grooming becomes more mainstream, depilatory products tailored for men (chest, back, facial hair) are gaining momentum.

Rapid E-commerce Penetration: Online platforms are making depilatory products more accessible, especially in emerging markets where digital retail is surging.

Clean-Label Movement: Growing consumer demand for cleaner, safer personal care products is driving formulations with fewer synthetic chemicals and more natural or skin-friendly ingredients.

These drivers present a robust opportunity for personal-care brands, grooming startups, and specialty manufacturers to innovate and differentiate in a growing market.

What Lies Ahead: Emerging Trends Shaping the Future

Key trends shaping the future of the depilatory product market include:

Gentler & Natural Depilatories: More formulations will focus on sensitive-skin-friendly ingredients, organic botanicals, and mild chemistries to meet consumer demand for non-irritating hair removal.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]Depilatory Product Market Size to Grow at a CAGR of 6.6% in the Forecast Period of 2025-2032

Depilatory Product Market

Market Estimation & Definition

The Depilatory Product Market includes a variety of hair-removal solutions—such as depilatory creams, wax-based kits, blades/razors, and electronic hair-removal devices—designed to temporarily remove unwanted hair. According to Stellar Market Research, the global depilatory product market was valued at approximately USD 7.03 billion in 2024 and is anticipated to grow to USD 11.73 billion by 2032, registering a compound annual growth rate (CAGR) of around 6.6% from 2025 to 2032.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Depilatory-Product-Market/1478

Market Growth Drivers & Opportunity

Several key factors are driving this strong market expansion:

Increasing Grooming & Beauty Awareness: Evolving beauty standards and personal grooming routines are fueling demand for effective and convenient hair-removal solutions.

Convenience of At-Home Use: Depilatory creams, wax kits, and electronic devices allow consumers to remove hair without visiting salons, providing both time savings and cost efficiency.

Innovative Product Formulations: Advances in depilatory chemistry—such as gentle, unscented, and natural-ingredient formulas—are addressing sensitivity concerns and expanding appeal to a wider user base.

Growth in Male Grooming: As male grooming becomes more mainstream, depilatory products tailored for men (chest, back, facial hair) are gaining momentum.

Rapid E-commerce Penetration: Online platforms are making depilatory products more accessible, especially in emerging markets where digital retail is surging.

Clean-Label Movement: Growing consumer demand for cleaner, safer personal care products is driving formulations with fewer synthetic chemicals and more natural or skin-friendly ingredients.

These drivers present a robust opportunity for personal-care brands, grooming startups, and specialty manufacturers to innovate and differentiate in a growing market.

What Lies Ahead: Emerging Trends Shaping the Future

Key trends shaping the future of the depilatory product market include:

Gentler & Natural Depilatories: More formulations will focus on sensitive-skin-friendly ingredients, organic botanicals, and mild chemistries to meet consumer demand for non-irritating hair removal.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]